Why Analyse an Industry

Many industry participants have similar business models. They often compete in the same or similar product markets as sellers and in factor markets as buyers, so they tend to be exposed to the same demand and supply opportunities and risk factors. As will be discussed later with Porter’s Five Forces model, these industry structural factors result in profitability differences by industry in the long run, with company-specific factors like business model variation, competitive strategy, size, and execution creating variance around the industry median.

Improve Forecasts

Competitive forces from industry incumbents, substitutes, suppliers, and customers discipline companies’ prices and costs, market share, and thus profitability. By taking an industry perspective and better understanding these drivers—as well as building a database of past competitive actions and strategies by firms in an industry and their track records of success—analysts can sharpen their forecasts and alertness to what is most important.

Identify Investment Opportunities

Industry analysis may uncover an attractive investment candidate that an analyst was previously unaware of or had not fully appreciated until assessing its strengths and weaknesses relative to industry peers and competitors. In addition, some investors may conclude that it is the industry, not any specific company, that they want exposure to, and in fact would like to diversify away the company-specific risks. These investors might take a basket approach by investing in several companies with position sizes scaled by size, liquidity, or relative attractiveness.

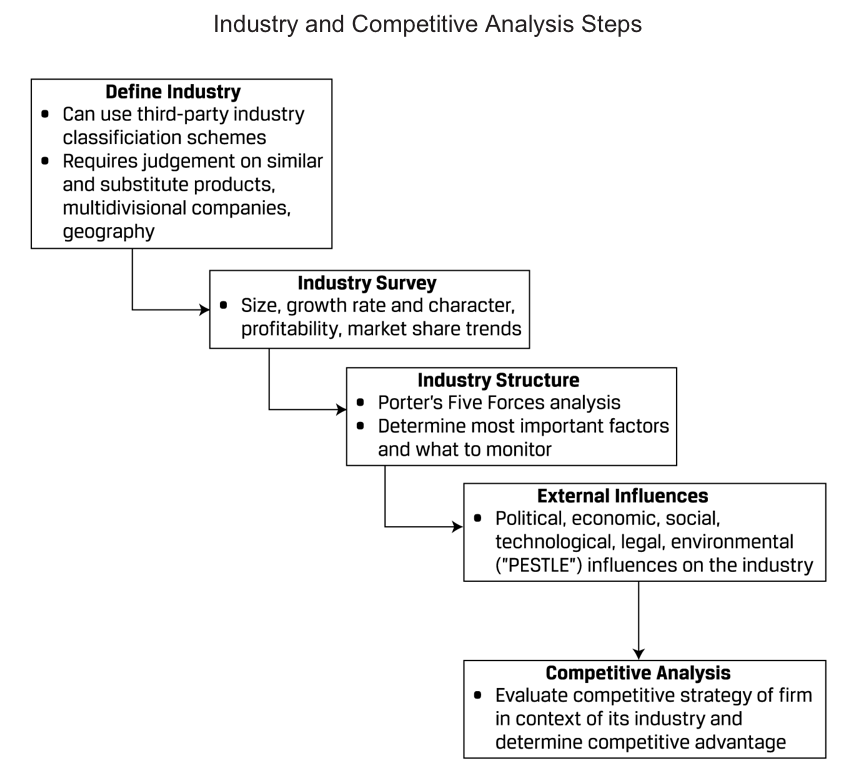

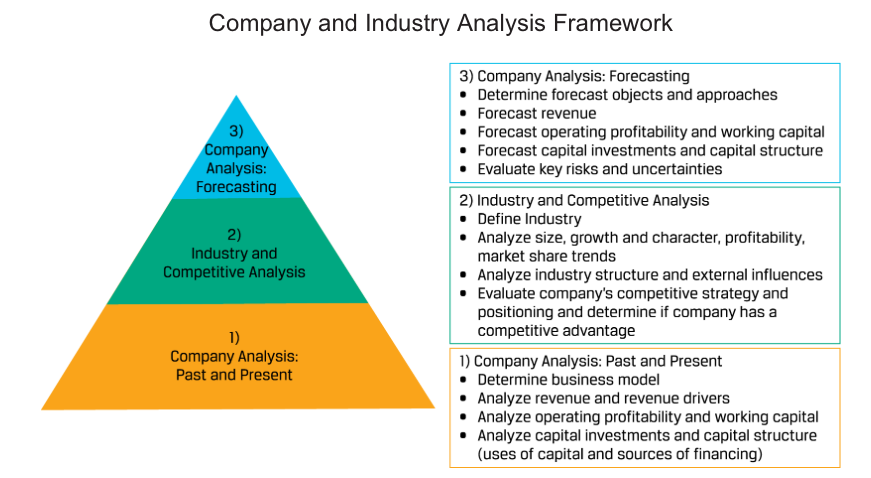

Industry and Competitive Analysis Steps