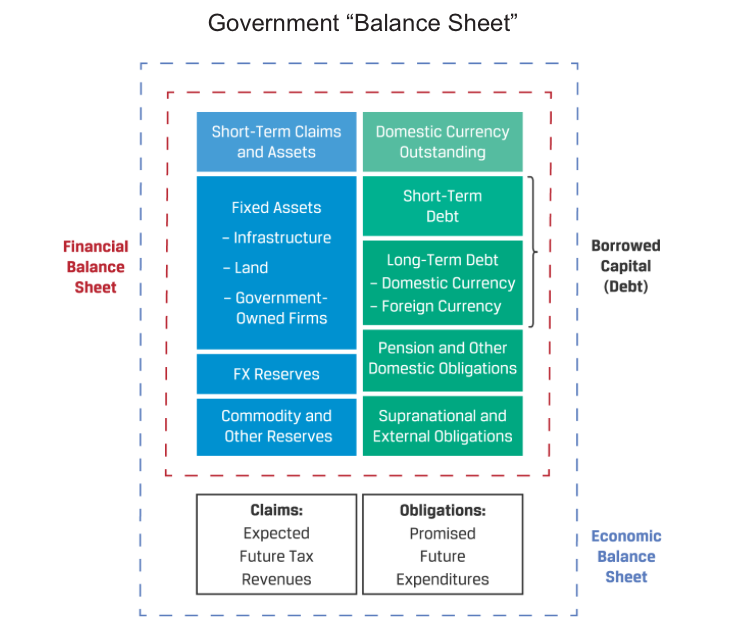

National or sovereign government issuers are distinguished by their legal authority to establish and maintain a country’s public goods and services and their ability to tax economic activity in their jurisdiction. Additional sources of repayment for their debt obligations include tariffs, usage fees, and cash flows from government-owned enterprises. The size and scope of public goods and services provided by national, versus regional or local, governments vary widely among markets, as does the degree of government involvement in the economy. Similar to private sector issuers, a government’s “economic balance sheet” may be used to illustrate the sources and uses of funding.

A key distinction among national government issuers is the difference between developed market and emerging market sovereign issuers.

- Developed market (DM) sovereign issuers

- Emerging market (EM) sovereign issuers

Government debt management policies address the composition of sovereign debt—that is, short term versus long term, as well as other features. Sovereign debt issues include the following:

- Short-term securities (with maturities ranging from 1 to 12 months), often known as Treasury bills, which are usually zero-coupon instruments sold at a discount to par.

- Medium- and long-term securities often known as Treasury notes and bonds. Fixed-rate coupon instruments in the domestic currency are most common, but sovereigns also issue floating-rate, inflation-linked, and foreign currency instruments.

- While not acting as the issuer, some sovereign governments guarantee certain other instruments that, in effect, make them a type of sovereign debt. The most prominent example is mortgage-backed securities, especially in the United States, that conform to certain criteria. Such instruments will be discussed in detail later.

The benefits of issuing sufficient longer-term sovereign government securities to maintain liquidity across maturities include the following:

- Establishment of a risk-free benchmark for all debt of specific maturities

- Use in managing and hedging market interest rate risk

- Preferred use as collateral in repo and derivative transactions

- Government bond use in monetary policy and foreign exchange reserves