Fixed-income investors face credit risk, a form of performance risk in a contractual relationship.

A borrower that fails to meet its promised interest and/or principal payment obligations under a bond or loan contract is said to be in default.

A fixed-income investor seeks compensation for the expected economic loss under a potential borrower default over the life of the contract known as credit risk.

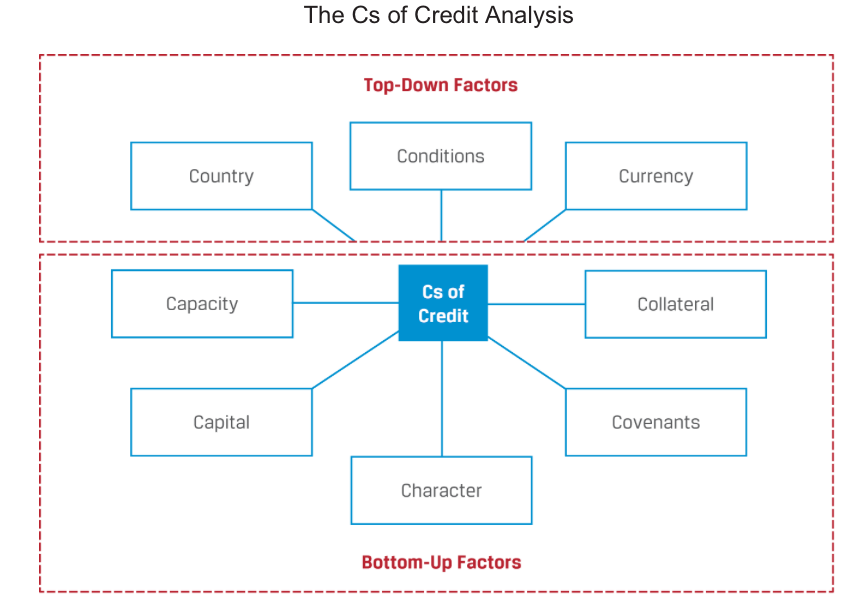

Five of these criteria—capacity, capital, collateral, covenants, and character—are related to the specific bottom-up factors applicable to an individual borrower.

- Capacity refers to the ability of the borrower to make its debt payments on time.

- Capital addresses other company resources available that reduce reliance on debt.

- Collateral refers to the quality and value of the assets supporting the issuer’s indebtedness.

- Covenants are the legal terms of debt agreements that an issuer must comply with.

- Character refers to the quality of management and the willingness of repay indebtedness.

Sources of Credit Risk

Measuring Credit Risk

The expected loss is

EL = POD × LGD,1

where LGD = EE × (1 – RR).

This approximation may be expressed as follows:

Credit Spread ≈ POD × LGD.