Solvency refers to a company’s ability to fulfill its long-term debt obligations. Assessment of a company’s ability to pay its long-term obligations (i.e., to make interest and principal payments) generally includes an in-depth analysis of the components of its financial structure. Solvency ratios, introduced in earlier modules in Corporate Issuers, provide information regarding the relative amount of debt in the company’s capital structure and the adequacy of earnings and cash flow to cover interest expenses and other fixed charges (such as lease payments) as they come due.

Calculation of Solvency Ratios

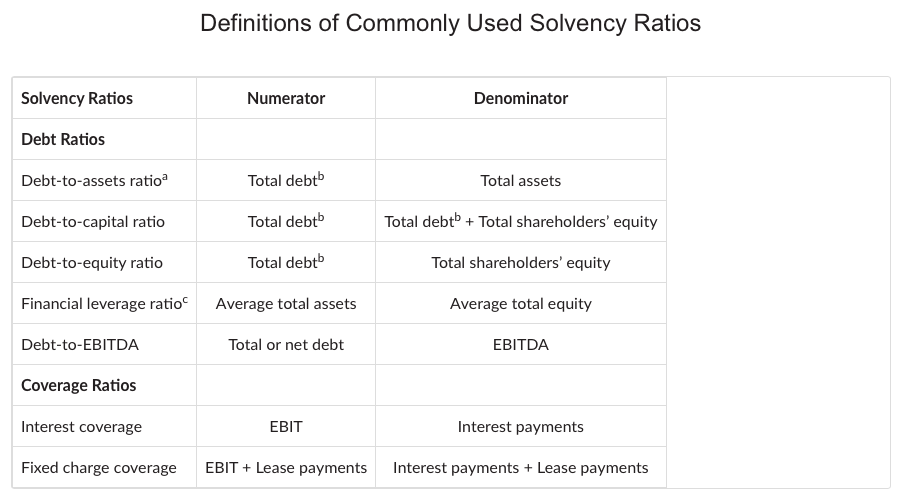

The two primary types of solvency ratios are debt ratios and coverage ratios.

Debt ratios focus on the balance sheet and measure the amount of debt capital relative to equity capital.

Coverage ratios focus on the income statement and measure the ability of a company to cover its debt payments

Interpretation of Solvency Ratios

Debt-to-Assets Ratio

This ratio measures the percentage of total assets financed with debt.

Debt-to-Capital Ratio

The debt-to-capital ratio measures the percentage of a company’s capital (debt plus equity) represented by debt. As with the previous ratio, a higher ratio generally means higher financial risk and thus indicates weaker solvency.

Debt-to-Equity Ratio

The debt-to-equity ratio measures the amount of debt capital relative to equity capital.

Financial Leverage Ratio

The financial leverage ratio (often called simply the “leverage ratio”) measures the amount of total assets supported for each one money unit of equity.

Debt-to-EBITDA Ratio

The debt-to-EBITDA ratio estimates how many years it would take to repay total debt based on earnings before income taxes, depreciation, and amortisation (an approximation of operating cash flow). This ratio is commonly used in debt covenants between issuers and debt investors.

Interest Coverage

The interest coverage ratio measures the number of times a company’s EBIT could cover its interest payments.

Fixed Charge Coverage

The fixed charge coverage ratio relates fixed charges, or obligations, to the cash flow generated by the company. It measures the number of times a company’s earnings (before interest, taxes, and lease payments) can cover the company’s interest and lease payments.