Both individuals and institutions invest in real property: either in residential or commercial real estate.

Residential real estate, or the housing market, consists of individual single-family detached homes and multi-family attached units, which share at least one wall with another unit, such as condominiums, cooperatives, townhouses, or terraced housing.

Commercial real estate includes primarily office buildings, retail shopping centres, commercial and residential rental properties, and warehouses. In contrast to the owner-occupied market, rental properties are leased to tenants.

Real Estate Investments

Real estate is uniquely different from other asset classes in several ways:

- The initial investment is typically large.

- Real estate is unique and distinct because there aren’t two identical properties; each piece of real estate is heterogeneous and is uniquely characterised in terms of location, age, tenant credit mix, lease term, and market demographics.

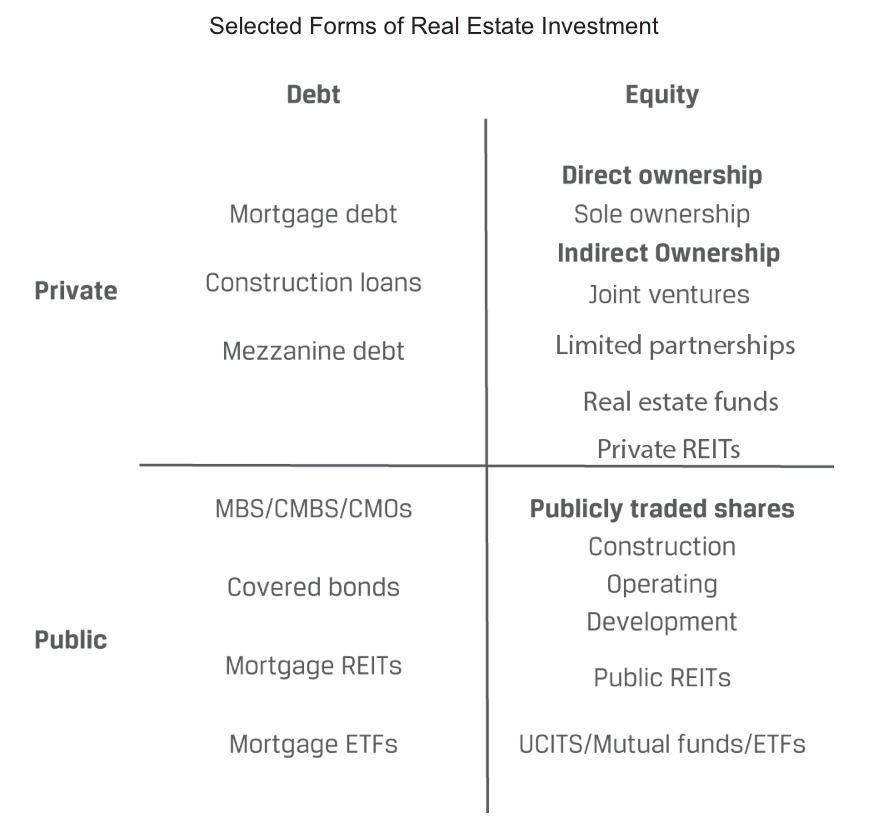

- There are multiple types of real estate investment alternatives available: direct and indirect investment options spanning the spectrum from relatively liquid investments in stable, income-producing properties to illiquid investments over a long development life cycle across the purchase, construction/upgrade, occupancy, and sales phases.

- Diversification across all different types of real estate investment alternatives may be difficult to attain.

- Private market indexes replicating the performance of real estate are not directly investable.

Additionally, the price discovery process in the private real estate markets is opaque, for multiple reasons:

- Historical prices may not reflect prevailing market conditions.

- Transaction costs are typically high. Buying and selling real estate can be a time-consuming process, involving real estate professionals, banks, lawyers, and others needed to facilitate these transactions.

- Transaction activity may be limited in certain markets due to either supply or demand conditions.

Real Estate Investment Structures

Direct Real Estate Investment

There are distinct advantages to owning real estate directly for property investors:

- Control. Only the owner can decide when to buy or sell, when and how much to spend on capital projects, whom to select as tenants based on credit quality preference and tenant mix, and what types of lease terms to offer. Owners generate cash flow returns from the use and enjoyment of the property, the receipt of lease payments, and the potential for capital appreciation.

- Tax benefits. The owners can reduce their taxable income using non-cash property depreciation expenses and tax-deductible interest expenses.

- Diversification. Historically, real estate has exhibited low correlation with other asset classes, and adding real estate to a portfolio has been demonstrated to increase portfolio diversification and reduce portfolio risk.

There are also disadvantages to investing directly in property:

- Complexity. The owners need to dedicate time to manage the property. Making the purchase itself is more complicated as well, with requirements including property selection, negotiating terms, performing due diligence, title search, contract review, and property inspection.

- Need for specialised knowledge. The owners need to understand both general and local market characteristics, which requires local market knowledge.

- Significant capital needs. The owners need to have access to a potentially significant amount of debt and equity capital because of the large initial capital outlay needed for real estate investments.

- Concentration risk. Owners, particularly smaller investors, cannot create a well-diversified real estate portfolio through direct investment.

- Lack of liquidity. It is typically difficult to quickly buy or sell direct investments in real estate, and transaction costs are typically high.

Indirect Real Estate Investment