Private capital is the broad term for funding provided to companies that is not sourced from the public markets, such as from the sale of equities, bonds, and other securities on exchanges, or from traditional institutional providers, such as a government or bank. Capital raised from sources other than public markets and traditional institutions and in the form of an equity investment is called private equity. Comparably sourced capital extended to companies through a loan or other form of debt is referred to as private debt. Private capital relates to the entire capital structure, comprising private equity and private debt.

Private equity strategies include leveraged buyout (LBO), venture capital (VC), and growth capital. Leveraged buyouts, or highly leveraged transactions, arise when private equity firms establish buyout funds (or LBO funds) to acquire public companies or established private companies, with a significant percentage of the purchase price financed through debt.

The LBO may also be of a specific type. In a management buyout (MBO), the current management team participates in the acquisition, and in a management buy-in (MBI), the current management team is replaced with the acquiring team involved in managing the company.

A manager may manage many private equity funds, each composed of several investments, and the companies owned are called portfolio companies because they will be part of a private equity fund portfolio.

Private Equity Investment Categories

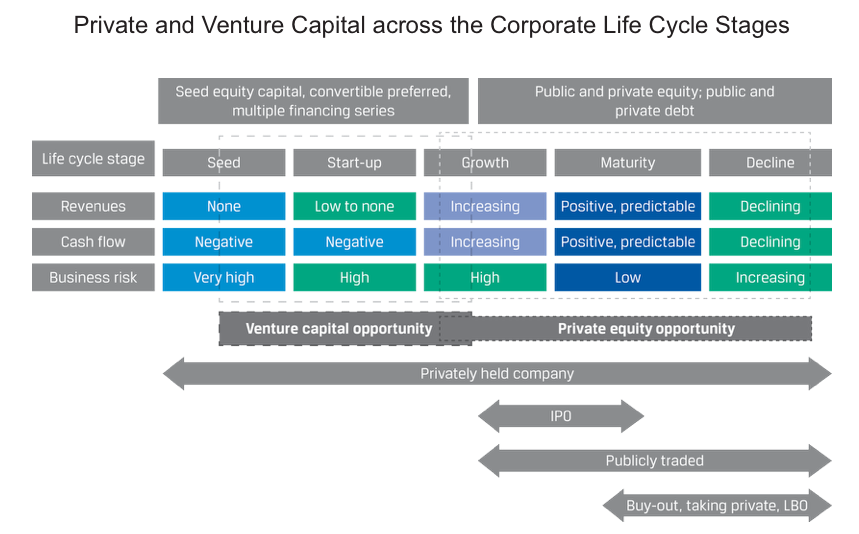

Venture capital entails investing in or providing financing to private companies with high growth potential. Typically, these are start-ups or young companies, but venture capital can be injected at various stages, ranging from concept creation for a company or near the point of a company’s IPO (initial public offering) launch or its acquisition. The investment return required varies with the company’s stage of development. Investors in early-stage companies will demand higher expected returns relative to later-stage investors because the earlier the stage of development, the higher the risk.

A PIPE (private investment in public equity) transaction is a private offering to select investors with fewer disclosures and lower transaction costs that allows the issuer to raise capital more quickly and cost-effectively than with other means that may be more regulated, expensive, and lengthy.

Private Equity Exit Strategies

Trade Sale

There are two main exit strategies: trade sale and public listing. In a trade sale, a portion or a division of the private company is sold either via direct sale or auction to a strategic buyer interested in increasing the scale and scope of the existing business. Because the transaction may have an impact on the competitive environment, it may face regulatory scrutiny and approval or management or employee resistance.

Public Listing

A special purpose acquisition company (SPAC) is a technique also used for a public exit. Such a “blank check” company exists solely for the purpose of acquiring an unspecified private company within a predetermined period; otherwise, it must return capital to investors.

Risk–Return from Private Equity Investments

Private equity investors expect ownership capital returns—cash flows from dividends and proceeds from exit—subject to underlying market conditions of the industry。