Buyers and sellers communicate with the brokers, exchanges, and dealers that arrange their trades by issuing orders.

All orders specify what instrument to trade, how much to trade, and whether to buy or sell. Most orders also have other instructions attached to them.

These additional instructions may include execution instructions, validity instructions, and clearing instructions.

Execution instructions indicate how to fill the order, validity instructions indicate when the order may be filled, and clearing instructions indicate how to arrange the final settlement of the trade.

In most markets, dealers and various other proprietary traders often are willing to buy from, or sell to, other traders seeking to sell or buy. The prices at which they are willing to buy are called bid prices and those at which they are willing to sell are called ask prices, or sometimes offer prices. The ask prices are invariably higher than the bid prices.

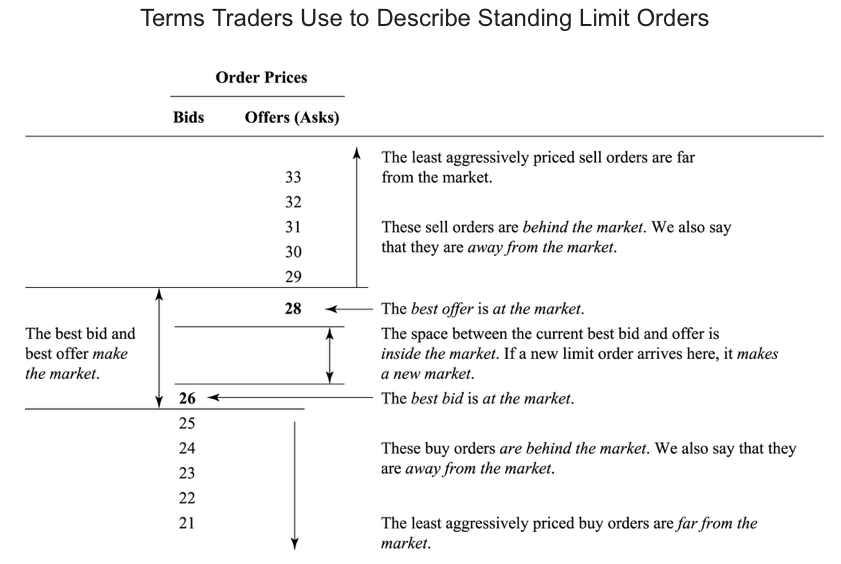

The highest bid in the market is the best bid, and the lowest ask in the market is the best offer. The difference between the best bid and the best offer is the market bid-ask spread.

Execution Instructions

Market and limit orders convey the most common execution instructions.

A market order instructs the broker or exchange to obtain the best price immediately available when filling the order.

A limit order conveys almost the same instruction: Obtain the best price immediately available, but in no event accept a price higher than a specified limit price when buying or accept a price lower than a specified limit price when selling.

The probability that a limit order will execute depends on where the order is placed relative to market prices. An aggressively priced order is more likely to trade than is a less aggressively priced order. A limit buy order is aggressively priced when the limit price is high relative to the market bid and ask prices. If the limit price is placed above the best offer, the buy order generally will partially or completely fill at the best offer price, depending on the size available at the best offer. Such limit orders are called marketable limit orders because at least part of the order can trade immediately. A limit buy order with a very high price relative to the market is essentially a market order.

If the buy order is placed above the best bid but below the best offer, traders say the order makes a new market because it becomes the new best bid. Such orders generally will not immediately trade, but they may attract sellers who are interested in trading. A buy order placed at the best bid is said to make market. It may have to wait until all other buy orders at that price trade first. Finally, a buy order placed below the best bid is behind the market. It will not execute unless market prices drop. Traders call limit orders that are waiting to trade standing limit orders.

A simplified limit order book in which orders are presented ranked by their limit prices for a hypothetical market.

Some order execution instructions specify conditions on size. For example, all-or-nothing (AON) orders can only trade if their entire sizes can be traded. Traders can similarly specify minimum fill sizes. This specification is common when settlement costs depend on the number of trades made to fill an order and not on the aggregate size of the order.

Exposure instructions indicate whether, how, and perhaps to whom orders should be exposed. Hidden orders are exposed only to the brokers or exchanges that receive them. These agencies cannot disclose hidden orders to other traders until they can fill them. Traders use hidden orders when they are afraid that other traders might behave strategically if they knew that a large order was in the market. Traders can discover hidden size only by submitting orders that will trade with that size. Thus, traders can only learn about hidden size after they have committed to trading with it.

Traders also often indicate a specific display size for their orders. Brokers and exchanges then expose only the display size for these orders. Any additional size is hidden from the public but can be filled if a suitably large order arrives. Traders sometimes call such orders iceberg orders because most of the order is hidden.