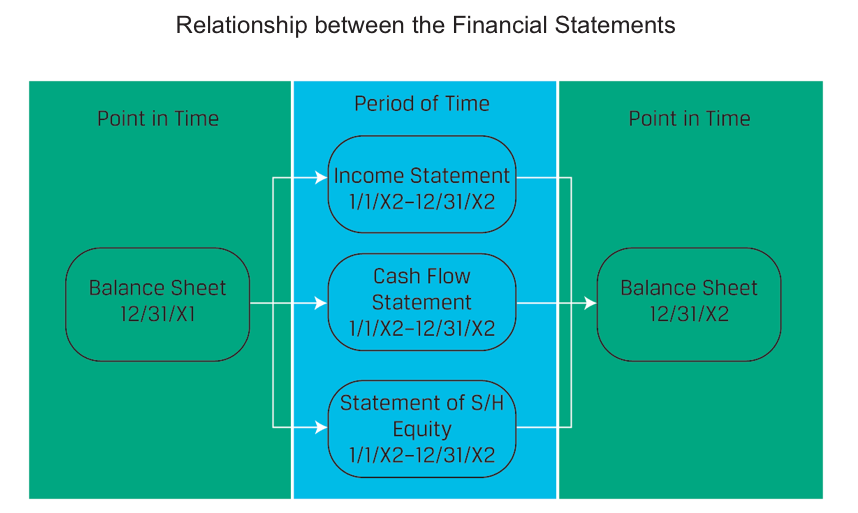

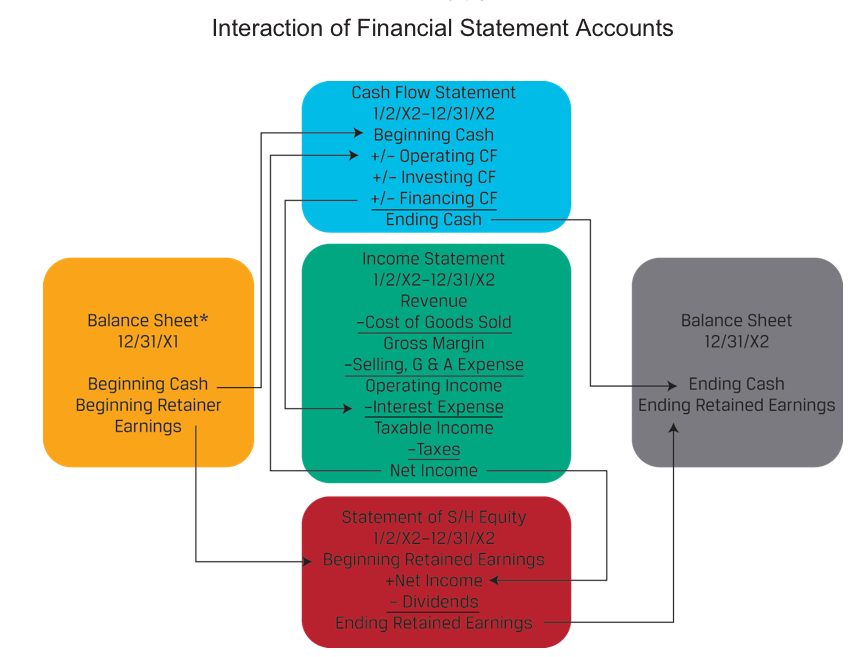

The primary financial statements are as follows:

- Balance Sheet—shows the financial position of an entity at a point in time, reporting the balances of “permanent” or “stock” accounts showing the entity’s assets and how those assets are financed.

- Income Statement—provides information about a company’s financial performance between balance sheet dates. The income statement is made up of revenue, expense, gain, and loss accounts. In contrast to the balance sheet, the income statement is a “flow” statement as it captures income activity between two balance sheet dates. Income statements prepared under IFRS or US GAAP are based on accrual accounting, so they do not necessarily reflect cash inflows and outflows.

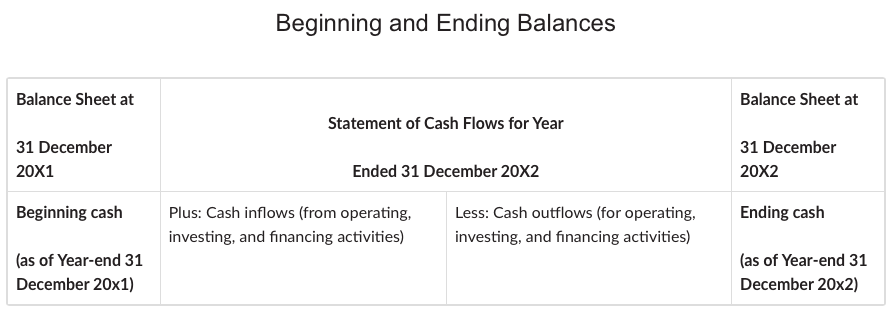

- Statement of Cash Flows—reports the change in an entity’s cash, cash equivalents, and restricted cash between balance sheet dates. The statement classifies cash inflows and outflows during the period as operating, investing, or financing activities. Because the cash flow statement reports performance over a period of time, it is also a “flow” statement, like the income statement.

- Statement of Shareholder’s Equity—provides information about how a company’s equity has changed between balance sheet dates. The statement identifies the significant components of shareholders equity that are reported on the balance sheet (e.g., common stock and retained earnings) and the activities that occurred during the period that impacted these accounts (e.g., share issuance, net income or loss). Like the income statement and statement of cash flows, the statement of shareholders equity is also a “flow” statement.

Relationship between Financial Statement

Linkages Between Current Assets and Current Liabilities

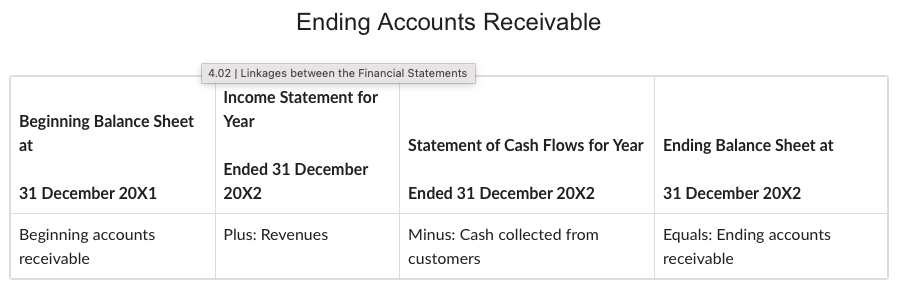

The income statement and statement of cash flows also provide key linkages between the current assets and current liabilities sections of the balance sheet. Differences between the accrual and cash accounting recognition of operating activities result in an increase or decrease in a current asset or liability on the balance sheet.

For example, accrual basis revenue in excess of cash collections will be accompanied by an increase in accounts receivable. If expenses reported using accrual accounting are lower than cash actually paid, the result will typically be a decrease in accounts payable or another accrued liability account. Finally, in situations in which a company is paid in advance for the delivery of a service or product in the future, it will recognise the cash received as an asset, but it also must recognise a liability for its obligation to deliver service or product in the future, typically referred to as deferred revenue. A deferred revenue liability account is derecognised upon the recognition of revenue when the entity satisfies its performance obligations.

Understanding the interrelationships among the balance sheet, income statement, and cash flow statement is useful not only in evaluating the company’s financial health but also in detecting accounting irregularities. Recall the extreme illustration of a hypothetical company that makes sales on account without regard to future collections and thus reports healthy sales and significant income on its income statement yet lacks cash inflow. Such a pattern would occur if a company improperly recognised revenue.