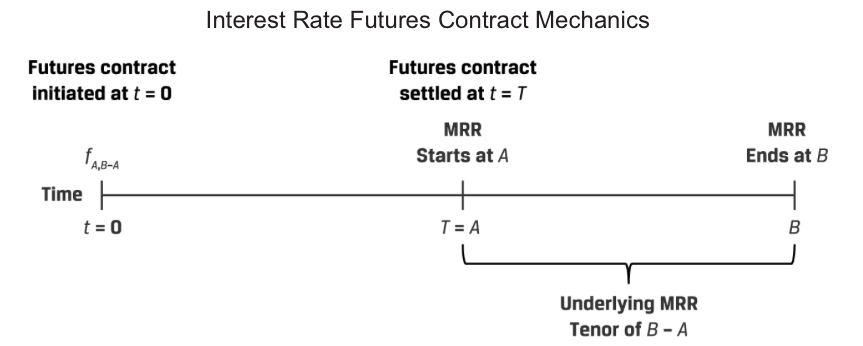

Futures markets on short-term interest rates offer market participants a highly liquid, standardized alternative to FRAs. Interest rate futures contracts are available for monthly or quarterly market reference rates for successive periods out to final contract maturities of up to ten years in the future. Although the underlying variable is the market reference rate (MRR) on a hypothetical deposit on a future date as for forward rate agreements, interest rate futures trade on a price basis as per the following general formula:

fA,B−A = 100 − (100 × MRRA,B−A),