Industry Size and Historical Growth Rate

Industry size is typically measured by total annual sales from the product or customer perspective, which is not necessarily all sales of each industry constituent.

Except for some industries that are dominated by large, publicly traded companies (e.g., autos, smartphones, airlines, pharmaceuticals), industry size will often include a potentially large amount in sales from private companies, sometimes small businesses, for which data are unavailable or impractical to tabulate.

Characterising Industry Growth

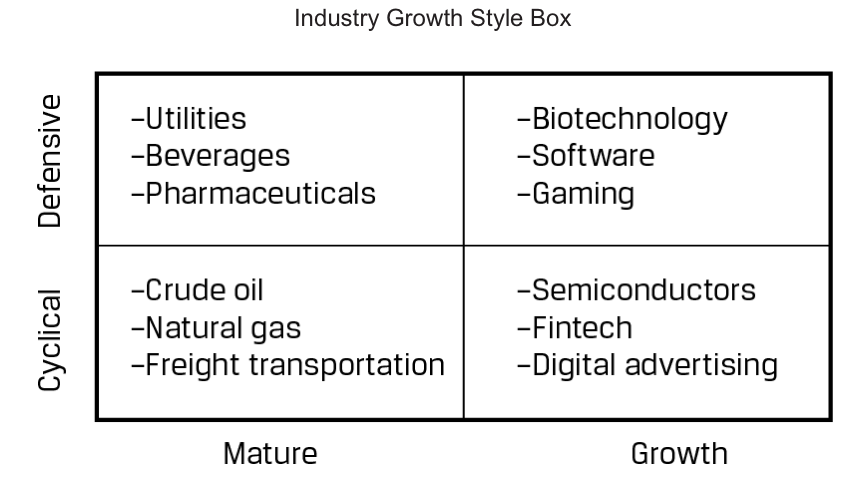

The pattern of historical growth of an industry can be used to characterise it based on the magnitude of its growth rate and sensitivity to the business cycle. One approach to characterising an industry’s growth rate is a style box.

Industry Profitability Measures

The best measure of industry profitability is a time series of the distribution of returns on invested capital (e.g., 25th, 50th, 75th percentiles), which captures after-tax operating profits for each dollar of invested capital and is agnostic about capital structure. However, unless the industry is dominated by public companies, obtaining these data is seldom feasible.

Market Share Trends and Major Players

Finally, market shares are measured by expressing industry participants’ annual revenues as percentages of the industry size each year. Given the aforementioned measurement problems with estimating industry size, market shares should be interpreted as a range rather than a definitive point estimate. Again, more important than each company’s market share is the trend over time, which can reveal whether customers have judged the company’s products superior to competitors’. An important consideration is acquisitions, particularly large ones; a company buying a competitor is a market share gain, but more important is whether the company is increasing or decreasing its share on an organic (non-acquired) basis.

A common measure of industry concentration is the Herfindahl-Hirschman Index (HHI), calculated as the sum of the squares of competitor market shares:

where s is the market share of market participant i stated as a whole number (i.e., 50% share = 50, not 0.50).