Implied Return for Fixed-Income Instruments

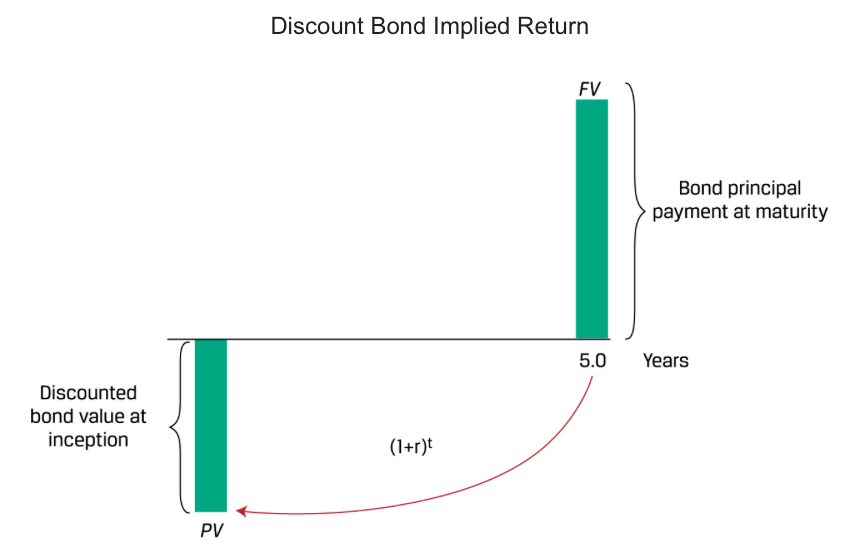

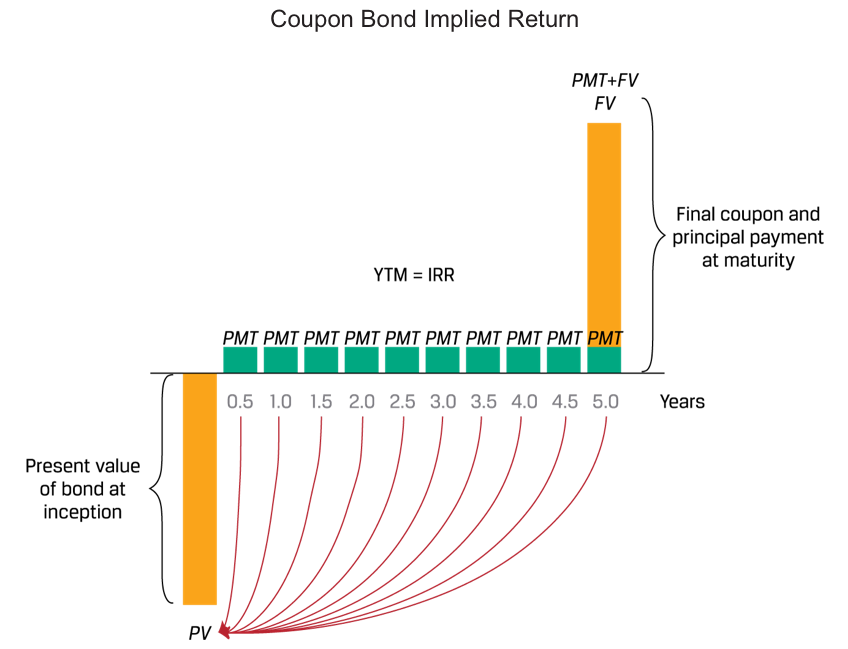

Fixed-income instruments are characterised by contractual interest and principal cash flows. If we observe the present value (or price) and assume that all future cash flows occur as promised, then the discount rate (r) or yield-to-maturity (YTM) is a measure of implied return under these assumptions for the cash flow pattern.

The YTM assumes an investor expects to receive all promised cash flows through maturity and reinvest any cash received at the same YTM. For coupon bonds, this involves periodic interest payments only, while for level payment instruments such as mortgages, the calculation assumes both interest and amortised principal may be invested at the same rate.

Equity Instruments, Implied Return, and Implied Growth

If we begin with an assumption of constant growth of dividends

A common practice is to compare ratios of share price to earnings per share, or the price-to-earnings ratio.

whereas the first term in the numerator on the right is the proportion of earnings distributed to shareholders as the dividends known as the dividend payout ratio.

In practice, the forward price-to-earning ratio or ratio of its share price to an estimate of its next period (t+1) earnings per share is commonly used.