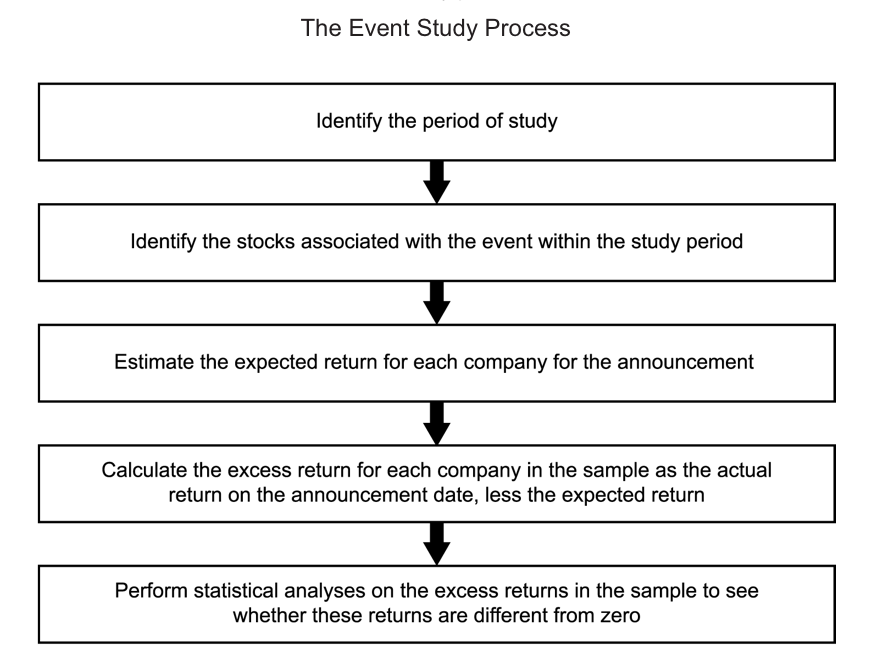

A finding that investors can consistently earn abnormal returns by trading on the basis of information is evidence contrary to market efficiency. In general, abnormal returns are returns in excess of those expected given a security’s risk and the market’s return. In other words, abnormal return equals actual return less expected return.

Weak Form

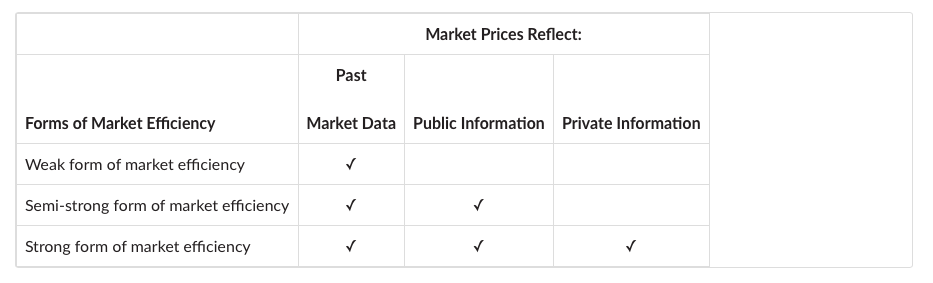

In the weak-from efficient market hypothesis, security prices fully reflect all past market data, which refers to all historical price and trading volume information.

An alternative approach to test weak-form efficiency is to examine specific trading rules that attempt to exploit historical trading data.

This approach is commonly associated with technical analysis, which involves the analysis of historical trading information (primarily pricing and volume data) in an attempt to identify recurring patterns in the trading data that can be used to guide investment decisions.

Semi-Strong From

In a semi-strong-from efficient market, prices reflect all publicly known and available information. Publicly available information includes financial statement data (such as earnings, dividends, corporate investments, changes in management, etc.) and financial market data (such as closing prices, shares traded, etc.). Therefore, the semi-strong form of market efficiency encompasses the weak form. In other words, if a market is semi-strong efficient, then it must also be weak-form efficient. A market that quickly incorporates all publicly available information into its prices is semi-strong efficient.

Strong Form

In a strong-form efficient market, security prices fully reflect both public and private information. A market that is strong-form efficient is, by definition, also semi-strong- and weak-form efficient. In the case of a strong-form efficient market, insiders would not be able to earn abnormal returns from trading on the basis of private information. A strong-form efficient market also means that prices reflect all private information, which means that prices reflect everything that the management of a company knows about the financial condition of the company that has not been publicly released.