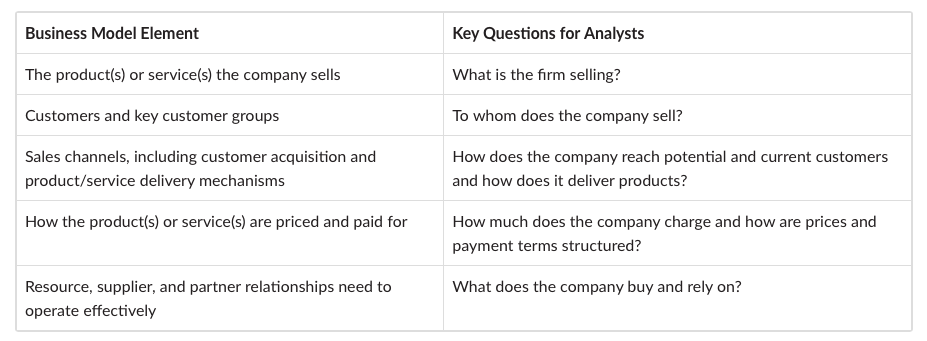

Determining the business model is the first step in our industry and company analysis framework because it summarises important drivers of an issuer’s financial results and position, focuses the analyst on what requires further investigation, and should begin setting the analyst’s expectations for the issuer.

Information sources that analysts use to answer these questions include the following, grouped by origin: the issuer, public third party, proprietary third party, and proprietary primary research.

- Issuer sources (available freely if the company is public)

- Regulatory filings, especially the annual and quarterly reports

- Quarterly or semi-annual earnings conference calls

- Presentations and events for investors

- Press releases

- Issuer management, investor relations, or other personnel

- Company website or properties that the analyst may be able to visit as either a customer or an investor. It is often useful to experience an issuer’s and its competitors’ products firsthand, though it is not always possible (e.g., pharmaceuticals).

- Public third-party sources

- Free industry white papers or analyst reports from a consultancy

- Economic or industry indicators from governments and other organisations

- General news outlets

- Industry-specific news outlets

- Social media

- Miscellaneous sources available via search engines

- Proprietary third-party sources

- Analyst reports and communications, including from “sell-side” or “Wall Street” analysts and credit rating agencies

- Reports and data from platforms such as Bloomberg and FactSet

- Reports and data from consultancies, often industry specific, such as Rystad in energy, IQVIA and Evaluate in biopharma, Gartner and IDC in information technology

- Proprietary primary research

- Surveys, conversations, product comparisons, and other studies commissioned by the analyst or conducted directly