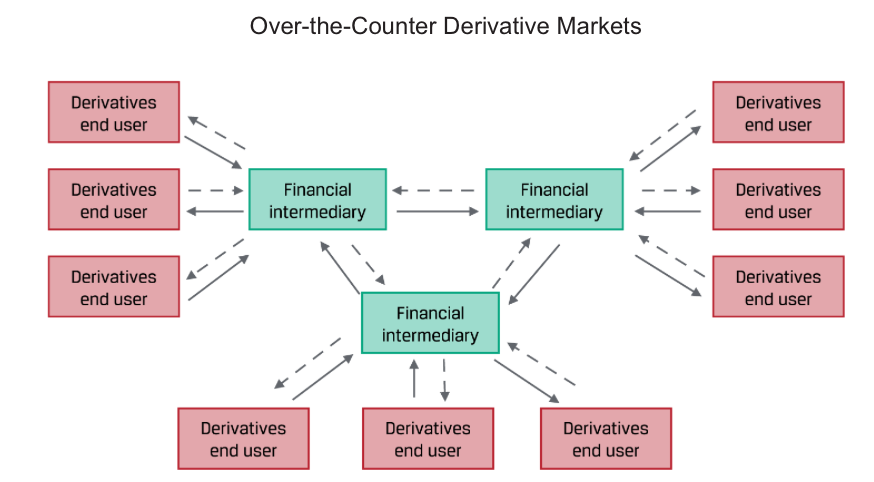

Over-the-Counter (OTC) Derivative Markets

OTC markets can be formal organisations, such as NASDAQ, or informal networks of parties that buy from and sell to one another, as in the US fixed-income markets. OTC derivative markets involve contracts entered between derivatives end users and dealers, or financial intermediaries, such as commercial banks or investment banks. OTC dealers, known as market makers, typically enter into offsetting bilateral transactions with one another to transfer risk to other parties. The terms of OTC contracts can be customised to match a desired risk exposure profile. This flexibility is important to end users seeking to hedge a specific existing or anticipated underlying exposure based upon non-standard terms.

Exchange-Traded Derivative (ETD) Markets

An exchange-traded derivative (ETD) includes futures, options, and other financial contracts available on exchanges, such as the National Stock Exchange (NSE) in India or the Brasil, Bolsa, Balcão (B3) exchange in Brazil. ETD contracts are more formal and standardised, which facilitates a more liquid and transparent market. Terms and conditions—such as the size of each contract, type, quality, and location of underlying for commodities and maturity date—are set by the exchange.

Central Clearing

Following the 2008 global financial crisis, global regulatory authorities instituted a central clearing mandate for most OTC derivatives. This mandate requires that a central counterparty (CCP) assume the credit risk between derivative counterparties, one of which is typically a financial intermediary. CCPs provide clearing and settlement for most derivative contracts. I