Definition and Features of a Derivative

A derivative is a financial instrument that derives its value from the performance of an underlying asset.

The asset in a derivative is called the underlying.

The underlying may not be an individual asset but rather a group of standardised assets or variables, such as interest rates or a credit index.

Market participants use derivative agreements to exchange cash flows in the future based on an underlying value.

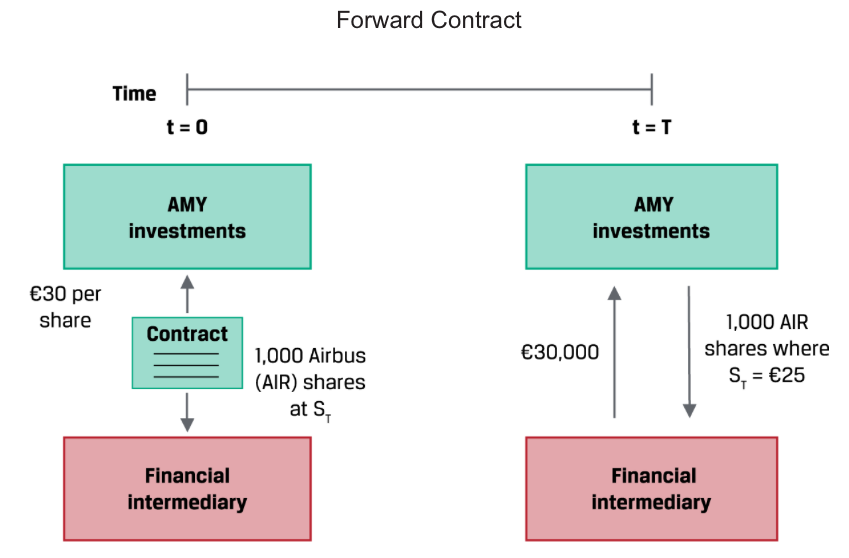

The one-time future exchange of publicly traded shares of stock at a fixed price in a derivative known as a forward contract.

A derivative does not directly pass through the returns of the underlying but transforms the performance of the underlying.

A derivative contract is a legal agreement between counterparties with a specific maturity, or length of time until the closing of the transaction, or settlement. The buyer of a derivative enters a contract whose value changes in a way similar to a long position in the underlying, and the seller has exposure similar to a short position. The contract size (sometimes referred to as notional principal or amount) is agreed upon at the outset and may remain constant or change over time.

An embedded derivative is a derivative within an underlying, such as a callable, puttable, or convertible bond.

Derivative markets expand the set of opportunities available to market participants to create or modify exposure to an underlying in several ways:

- Investors can sell short to benefit from an expected decline in the value of the underlying.

- Investors may use derivatives as a tool for portfolio diversification.

- Issuers may offset the financial market exposure associated with a commercial transaction.

- Market participants may create large exposures to an underlying with a relatively small cash outlay.

- Derivatives typically have lower transaction costs and are often more liquid than underlying spot market transactions.