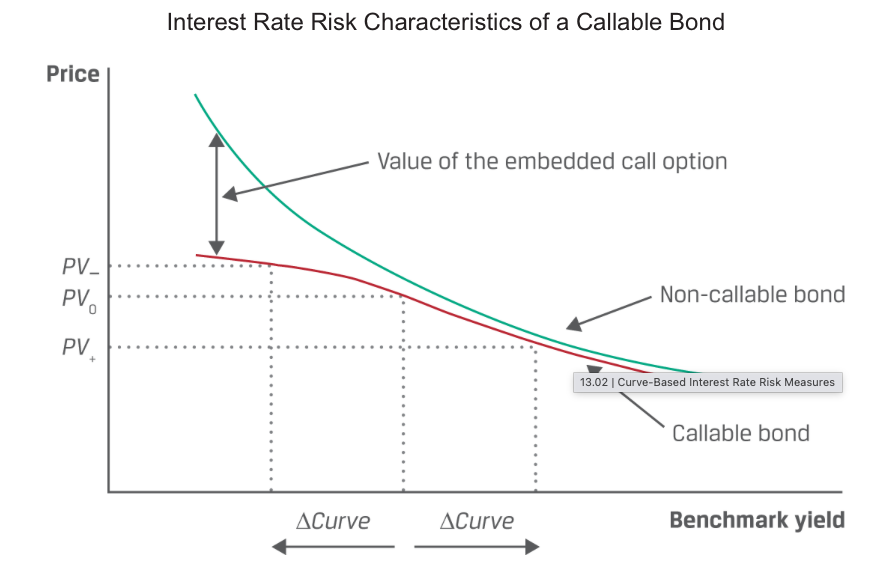

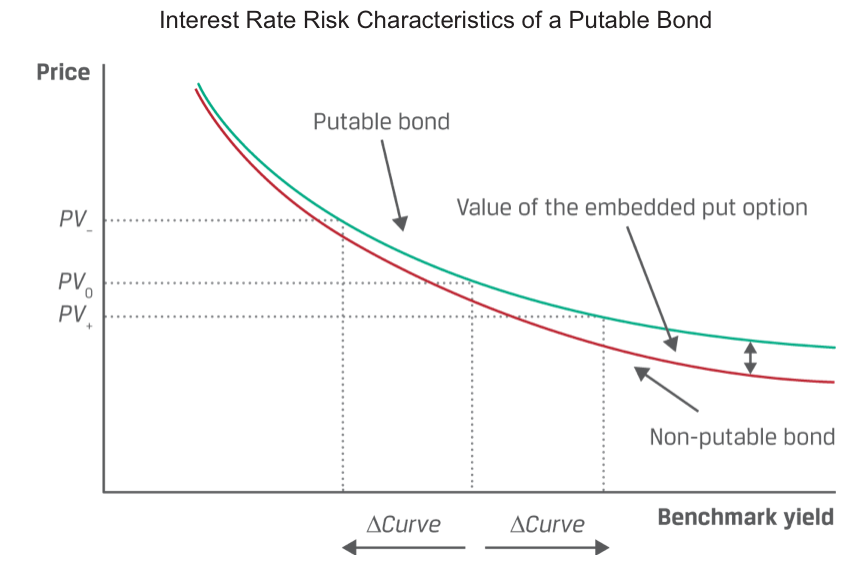

Yield duration and convexity assume a bond’s cash flows are certain. However, if a bond has contingency features, such as embedded options, as with a callable (or puttable) bond, then future cash flows are uncertain since option exercise depends on the level of market interest rates relative to coupon interest being paid (or received). For example, the duration of a callable bond does not reflect the sensitivity of the bond price to a change in the yield-to-worst, since this represents only one of several possible outcomes based on future interest rates.

Calculating effective duration (EffDur) is very similar to calculating approximate modified duration,

The formula for calculating effective convexity (EffCon) is also very similar to the formula for approximate convexity,