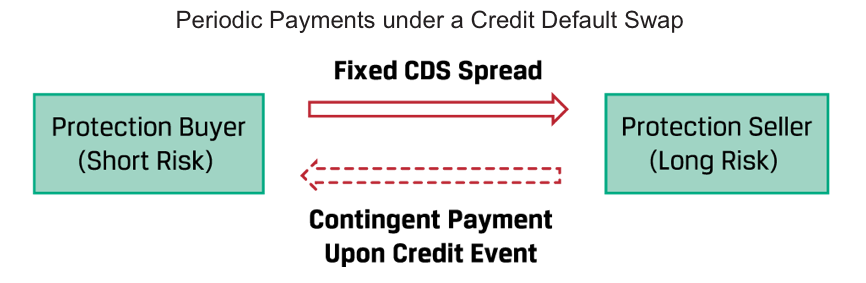

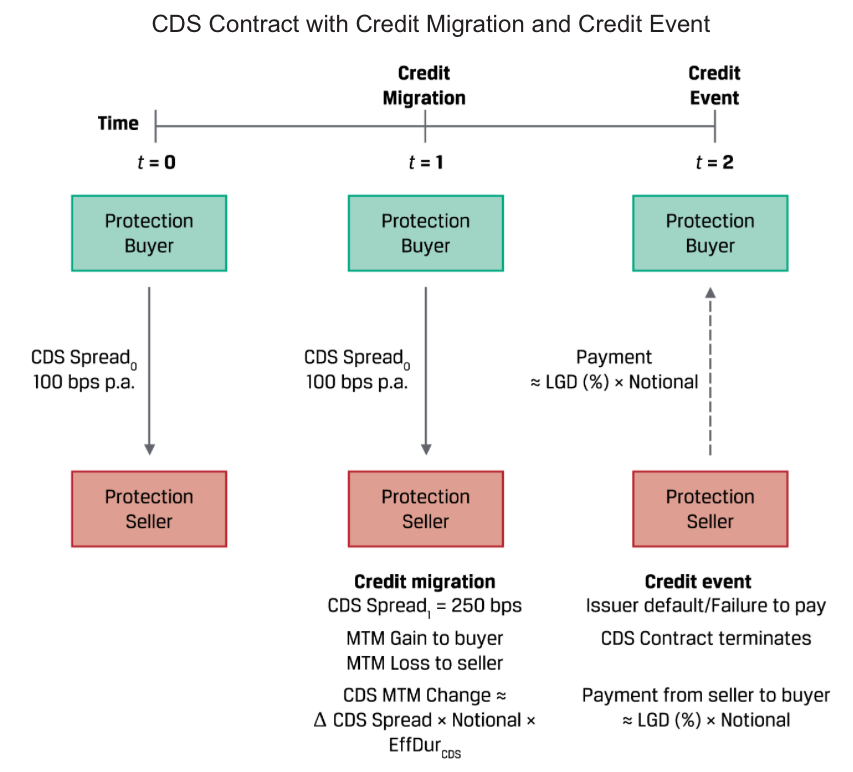

Credit derivative contracts are based on a credit underlying, or the default risk of a single debt issuer or a group of debt issuers in an index. The most common credit derivative contract is a credit default swap. CDS contracts allow an investor to manage the risk of loss from issuer default separately from a cash bond. CDS contracts trade based on a credit spread (CDS credit spread) similar to that of a cash bond. Credit spreads depend on the probability of default (POD) and the loss given default (LGD), as shown in an earlier lesson. A higher credit spread (or higher likelihood of issuer financial distress) corresponds to a lower cash bond price, and vice versa.