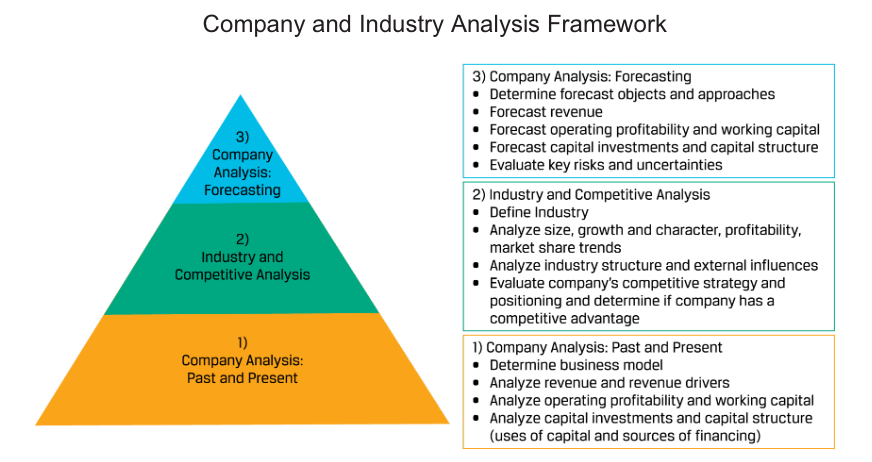

Analysts value and make investment recommendations on issuers’ equity securities using scenarios of future earnings, cash flows, and financial position. These future scenarios are structured in the form of financial statements and are known as financial statement models. While a financial statement model is quantitative, it is not a mathematics problem to solve with a correct answer, but rather a quantitative expression of an analyst’s forward-looking views. These views should be based on supporting evidence and justified by analysis.

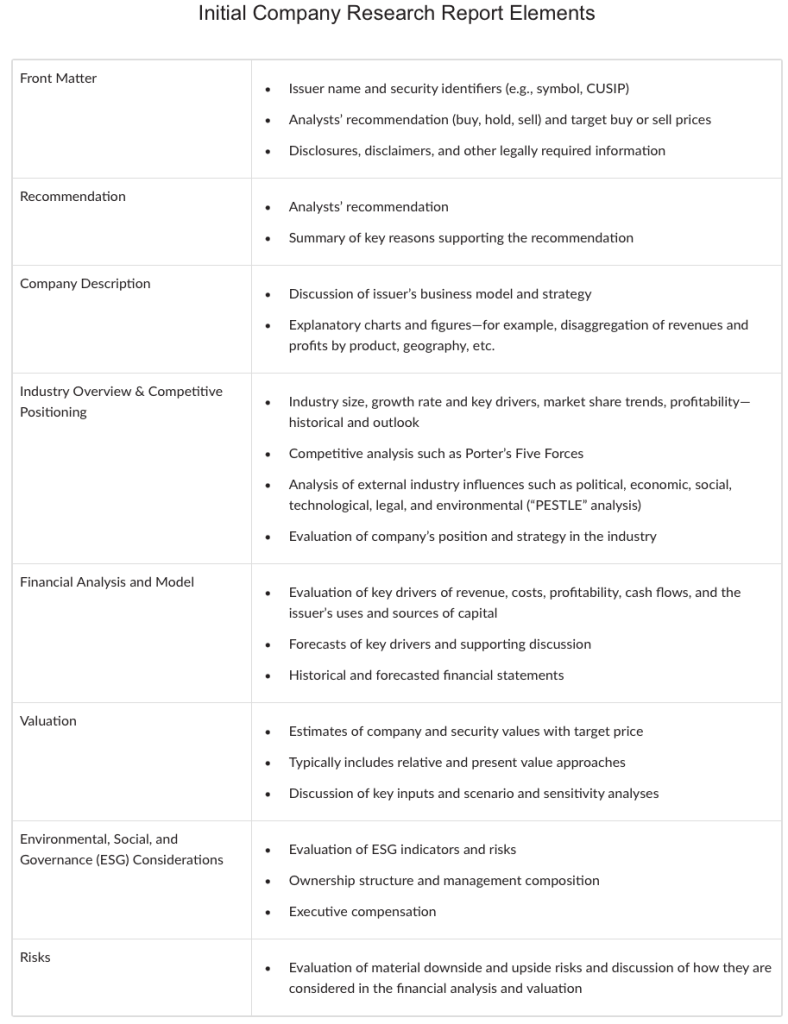

Analysts present their company and industry analysis, as well as their valuation and investment recommendation, in a company research report. The structure, content, and tone of the report depend on the analyst’s setting. Reports on a public issuer’s equity securities for distribution to external clients (a “sell-side report”),

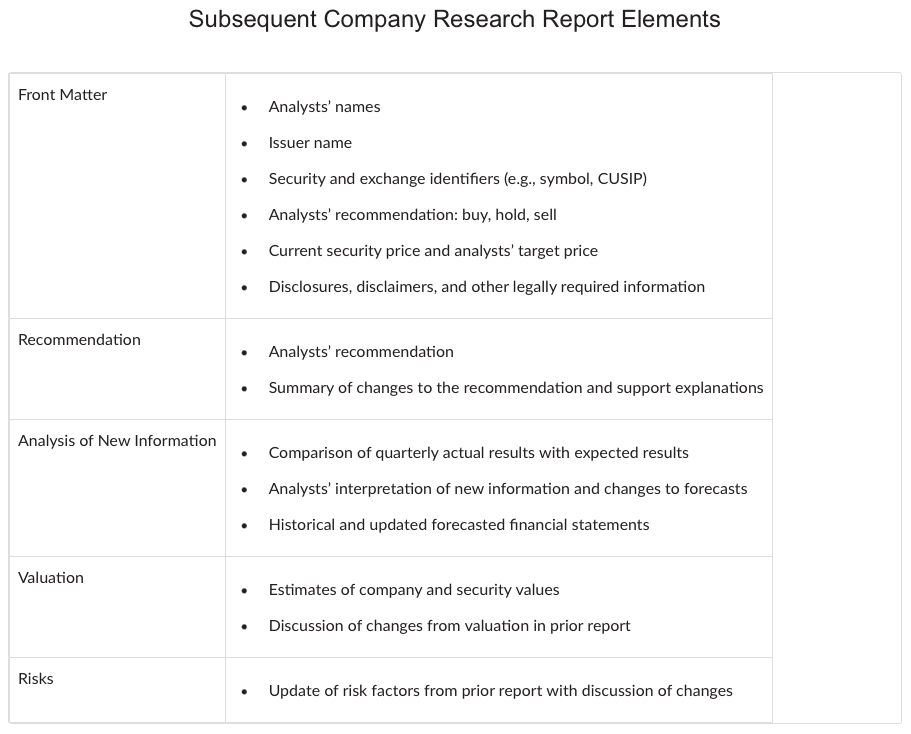

Subsequent company research reports are often shorter than initial reports. Their primary audience is those who are already familiar with the issuer or security and require an update based on new information and analyses or a change in the analyst’s recommendation.