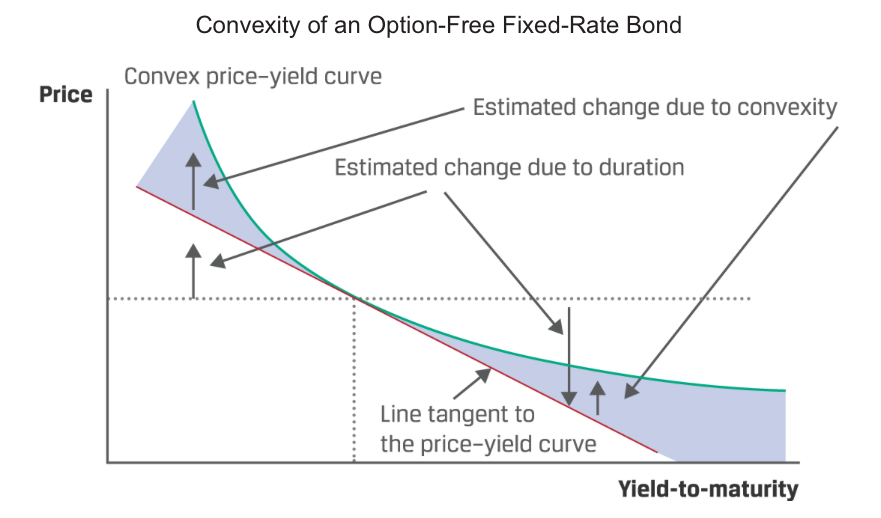

Convexity is a complementary risk metric that measures the second-order (non-linear) effect of yield changes on price for an option-free fixed-rate bond.

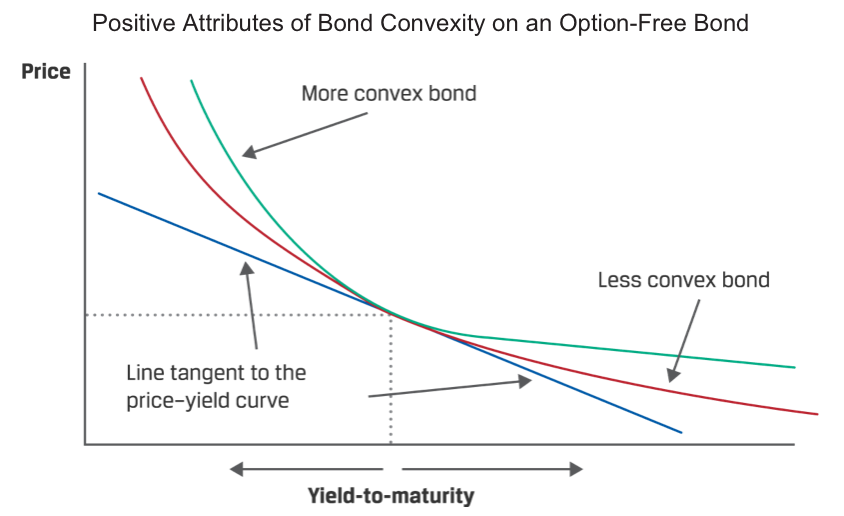

The true relationship between a bond’s price and its yield-to-maturity is the curved (convex) line that shows the actual bond price given its market discount rate. Duration (i.e., money duration) estimates the change in the bond price along the straight line tangent to the curved line. For small yield-to-maturity changes, there is little difference between the lines.

Convexity adds to the estimate of the percentage (full) price change provided when using modified duration by itself,

Note that this equation uses the same inputs as approximating modified duration.