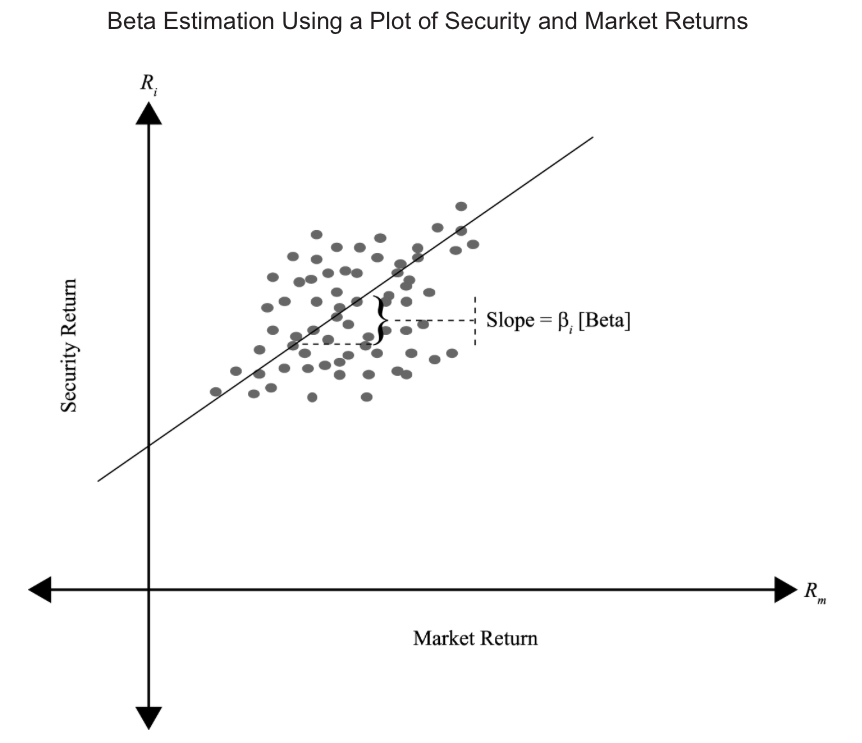

beta is a measure of how sensitive an asset’s return is to the market as a whole and is calculated as the covariance of the return on i and the return on the market divided by the variance of the market return; that expression is equivalent to the product of the asset’s correlation with the market with a ratio of standard deviations of return (i.e., the ratio of the asset’s standard deviation to the market’s).

Estimation of Beta

Beta and Expected Return