Infrastructure investments have a societal purpose; facilitate broad economic, technological, and social development purposes; and usually combine land, buildings, and other long-lived fixed assets. Infrastructure supports public transportation, airports, utilities (water, gas, and electricity), and more recently, information (telecommunication, cable, and wireless networks).

Infrastructure Investments

Infrastructure investments often involve a consortium that combines one or several strategic partners that have specialised operational or technical skills with the financial investors. Rather than leases or rentals from commercial or residential tenants, infrastructure cash flows in most cases arise from contractual payments, such as the following:

- Availability payments, which are payments that are received to make the facility available

- Usage-based payments, such as tolls and fees for using the facilities

- “Take-or-pay” arrangements, which obligate buyers to pay a minimum purchase price to sellers for a pre-agreed volume.

Categories of Infrastructure Investments

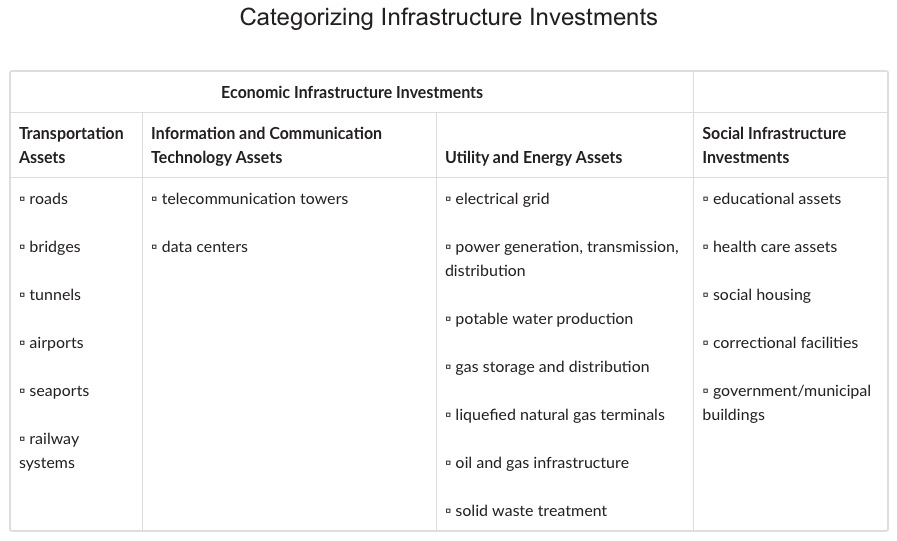

Economic infrastructure investments support economic activity through transportation assets, information and communication technology (ICT) assets, and utility and energy assets:

- Transportation assets include roads, bridges, tunnels, airports, seaports, and heavy and light/urban railway systems. Income will usually be linked to demand based on traffic, airport and seaport charges, tolls, and rail fares and hence is deemed to carry market risk.

- ICT assets include infrastructure that stores, broadcasts, and transmits information or data, such as telecommunication towers and data centres.

- Utility and energy assets generate power and produce potable water; transmit, store, and distribute gas, water, and electricity; and treat solid waste.

Stages of Infrastructure Development

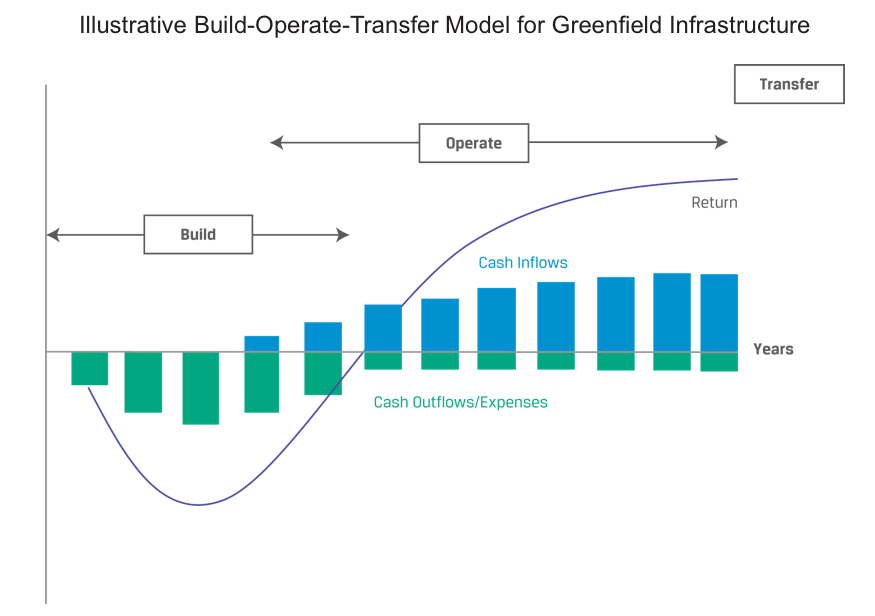

Greenfield investments, developing new assets and new infrastructure, are opportunistic investments. The intent may be to lease or sell the assets to the government after construction or to hold and operate the assets. If they are held, it can be over the long term or for a shorter period until operational maturity, with subsequent sale to new investors, thus ensuring capital appreciation to reflect the construction and commissioning risk. Greenfield investors typically invest alongside strategic investors or developers that specialise in developing the underlying assets.

Forms of Infrastructure Investment

- Direct investment in the underlying infrastructure provides control and the opportunity to capture full value. It requires a large investment and results in both concentration and liquidity risks while the assets are managed and operated.

- Indirect investments include infrastructure funds (similar in structure to private equity funds and either closed end or open end), infrastructure ETFs, and holding equity in publicly traded infrastructure providers, or master limited partnerships (MLPs).