Alternative Investment Performance Appraisal

Appraising the performance of alternative investments requires more scrutiny in certain areas than traditional asset classes do.

Comparability with Traditional Asset Classes

Alternative investments are customised investments whose distinctive features complicate performance appraisal between investments and across asset classes. These features include

- the timing of cash inflows and outflows for specific investments,

- the use of borrowed funds,

- the valuation of individual portfolio positions over specific phases of the investment life cycle, and

- more complex fee structures and tax and accounting treatment.

Performance Appraisal and Alternative Investment Features

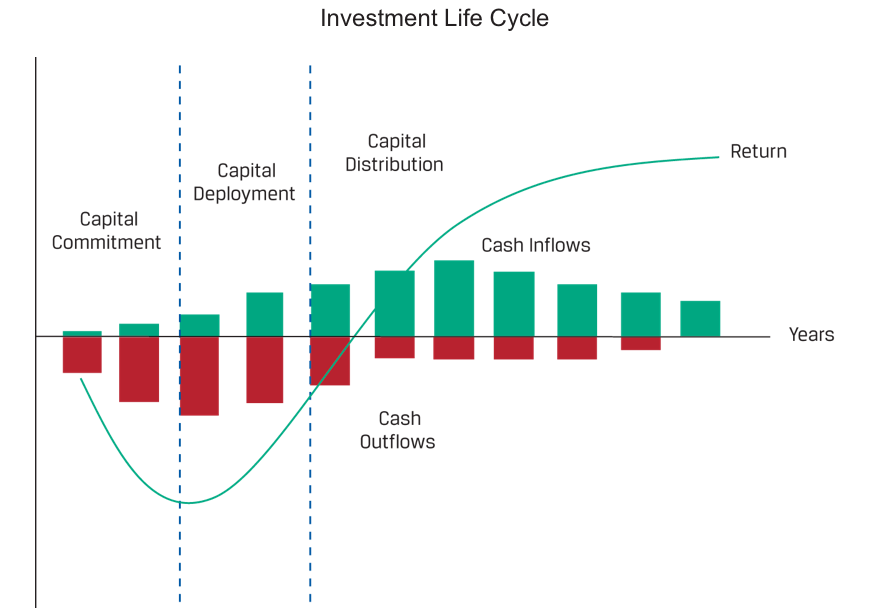

Investment Life Cycle

- Capital commitment: Alternative managers identify and select appropriate investments with either an immediate or a delayed commitment of capital (known as a capital call) that may be in an early-stage company in the case of venture capital, a more mature firm for private equity, or one or more properties in the case of real estate. Returns are usually negative over this phase because fees and expenses are immediately incurred prior to capital deployment and assets may generate little or no income during this first phase.

- Capital deployment: Over this second phase, alternative managers deploy funds to engage in construction or make property improvements in the case of real estate or infrastructure, incur expenses in the turnaround phase of a mature company in the case of private equity, or initiate operations for a startup using venture capital. Cash outflows typically exceed inflows, with management fees further reducing returns.

- Capital distribution: When the turnaround strategy, startup phase, or property improvements are completed and if the investment is successful, the underlying assets appreciate in price and/or generate income in excess of costs, causing fund returns to accelerate. The fund may realise substantial capital gains from liquidating or exiting its investments, which may involve an initial public offering (IPO) for venture capital or the sale of properties in the case of real estate.

Because of this complexity, a shortcut methodology often used by both private equity and real estate managers involves simply citing a multiple of invested capital (MOIC), or money multiple, on total invested capital (which is paid-in capital less management fees and fund expenses). Here, one simply measures the total value of all realised investments and residual asset values (assets that may still be awaiting their ultimate sale) relative to an initial total investment. MOIC is calculated as follows:

MOIC = (Realised value of investment + Unrealised value of investment)/Total amount of invested capital.

Use of Borrowed Funds

Calculate a simple leveraged rate of return rL for the period as follows:

rL = Leveraged portfolio return/Cash position = [r × (Vc + Vb) – (Vb × rb)]/Vc .

The relationship between the cash portfolio return, r, and the leveraged rate of return, rL , as follows:

rL = r + Vb /Vc (r – rb).

Hedge funds leverage their portfolios by using derivatives or borrowing capital from prime brokers, negotiating with them to establish margin requirements, interest, and fees in advance of trading. In a typical margin financing arrangement, the prime broker essentially lends the hedge fund the shares, bonds, or derivatives, and the hedge fund deposits cash or other collateral into a margin account with the prime broker based on certain fractions of the investment positions.

Leverage is a large part of the reason that some hedge funds either earn larger-than-normal returns or suffer significant losses. If the margin account or the hedge fund’s equity in a position declines below a certain level, the lender initiates a margin call and requests that the hedge fund put up more collateral. An inability to meet margin calls can have the effect of magnifying or locking in losses because the hedge fund may have to liquidate (close out) the losing position. This liquidation can lead to further losses if the order size is sufficiently large to move the security’s market price before the fund can sufficiently eliminate the position. Under normal conditions, the application of leverage may be necessary for yielding meaningful returns from given quantitative, arbitrage, or relative value strategies. But with added leverage comes increased risk.

Valuation

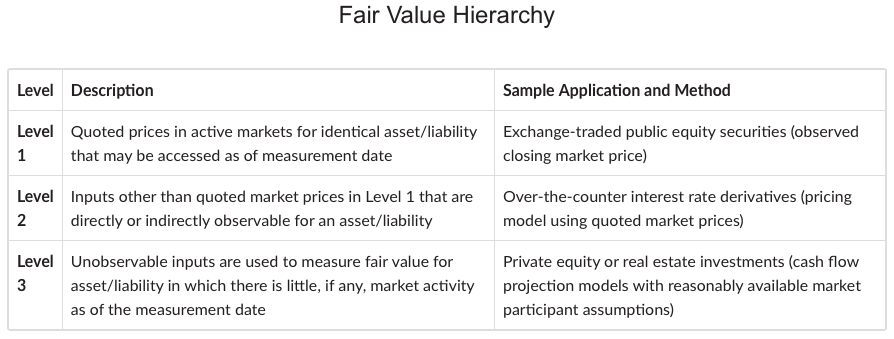

Accounting rules dictate that investments must be recorded at their fair value for financial reporting purposes. The fair value of an investment is a market-based measure based on observable or derived assumptions to determine a price that market participants would use to exchange an asset or liability (often referred to as the exit price for a seller) in an orderly transaction at a specific time.

Fees

Alternative investment fees also vary from those for common asset classes, which typically involve a flat management fee. Alternative investments often levy additional performance fees based on a percentage of periodic fund returns. Performance appraisal for these investments can be difficult to generalise, because results may vary significantly based on which investor has invested when in a particular vehicle.