Beyond the direct or indirect method of investing in alternatives, the illiquidity, complexity, and long-term nature of these investments require more complex structures to bridge potential gaps between manager and investor interests.

Alternative investment structures may explicitly address both the roles and responsibilities of investors and managers to address these gaps.

In addition, alternative investment structures tailor the distribution of returns between these two parties to better align the incentives (or interests) between manager and investor.

Alternative Investment Ownership and Compensation Structures

Ownership Structures

Alternative investment vehicles often take the form of partnerships in order to maximize flexibility in the investment structure to allocate business risk and return and to distribute special responsibilities between investors and managers as required.

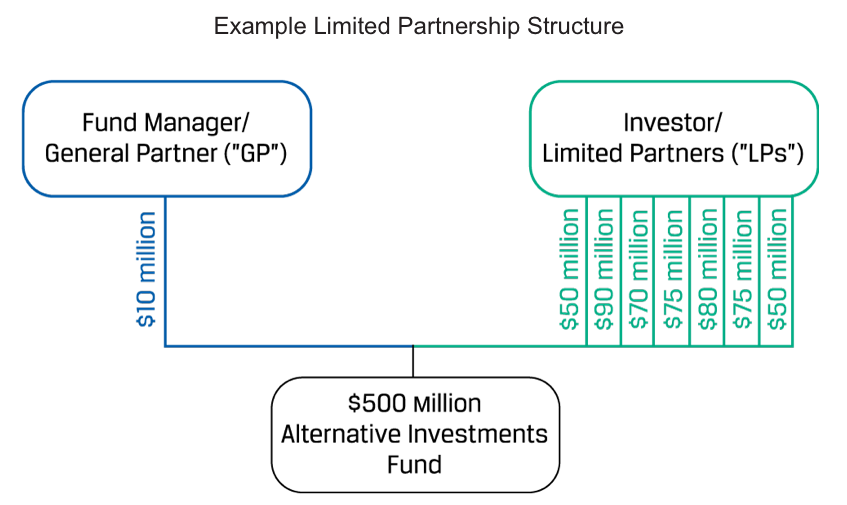

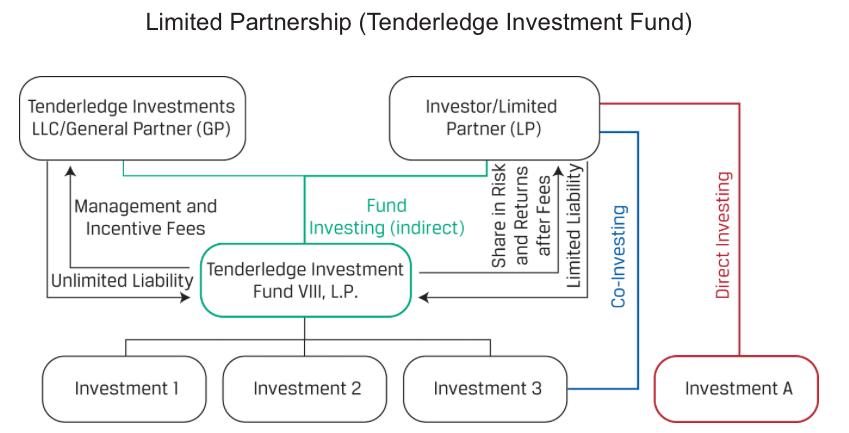

Limited partnerships, introduced in a corporate issuer lesson, involve at least one general partner (GP) with theoretically unlimited liability who is responsible for managing the fund.

Limited partners (LPs) are outside investors who own a fractional interest in the partnership based on the amount of their initial investment and the terms set out in the partnership documentation.

LPs commit to future investments, and the upfront cash outflow can be a small portion of their total commitment to the fund. Funds set up as limited partnerships typically have a limit on the number of LPs allowed to invest in the fund. LPs play passive roles and are not involved with the management of the fund (although co-investment rights allow for the LPs to make additional direct investments in the portfolio companies); the operations and decisions of the fund are controlled solely by the GP.

A restricted number of limited partners hold a fractional interest in the fund. LP investors must generally meet certain minimum regulatory net worth, institutional, or other requirements, as so-called accredited investors, to access these investments, which are less regulated than general public offerings.

Compensation Structures