Alternative Investment Methods

Investors can access alternative investments in three ways:

- Fund investment (such as a in a PE fund)

- Co-investment into a portfolio company of a fund

- Direct investment into a company or project (such as infrastructure or real estate)

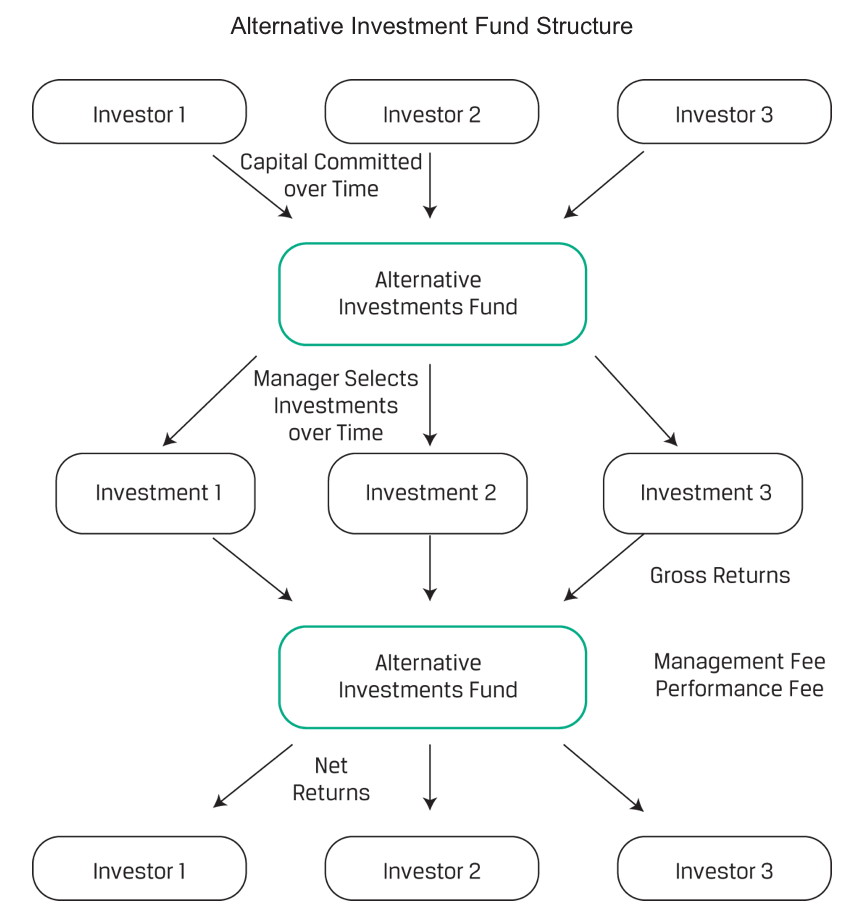

Fund Investment

Investors with limited resources and/or experience generally enter into alternative investments through fund investing, where the investor contributes capital to a fund and the fund identifies, selects, and makes investments on the investor’s behalf. For the fund’s services, the investor is charged a management fee, plus a performance fee if the fund manager delivers superior results versus a hurdle rate or benchmark.

Co-Investment

Once investors have some experience investing in funds, prior to investing directly themselves, many investors gain direct investing experience via co-investing, where the investor invests in assets indirectly through the fund but also possesses rights (known as co-investment rights) to invest directly in the same assets.

Through co-investing, an investor is able to make an investment alongside a fund when the fund identifies deals; the investor is not limited to participating in the deal solely by investing in the fund.

Managers benefit from choosing one or more co-investors to

- accelerate investment timing when available funds and expected inflows are insufficient for a specific deal,

- expand the scope of available new investments, and

- increase diversification of an existing pool of fund investments.

Direct Investment

The largest, most sophisticated investors with sufficient skills and knowledge to manage individual alternative investments often do so via direct investing without the use of an intermediary.