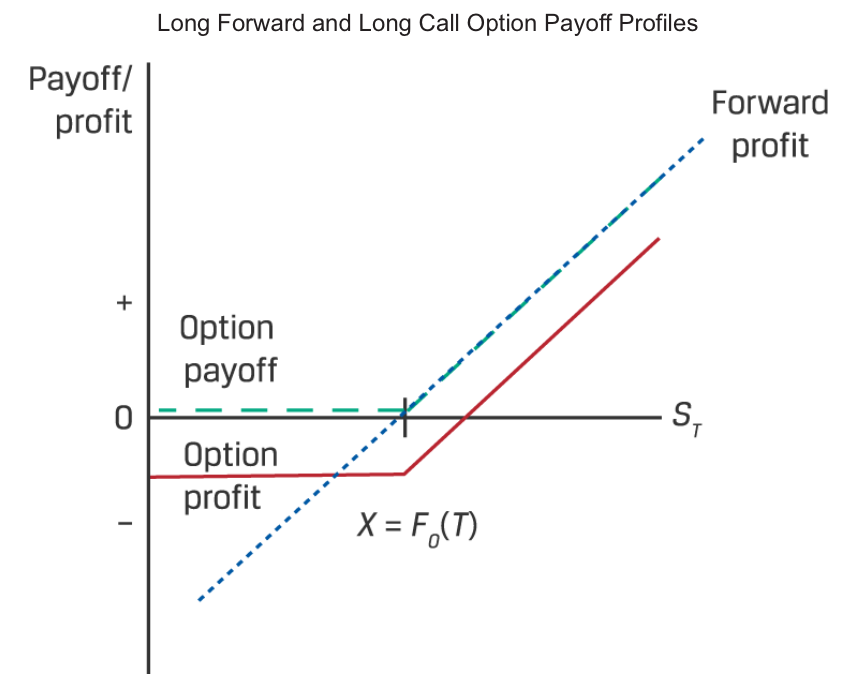

Both the long forward and the call option payoffs increase as ST rises. In the case of a forward, this linear relationship is equal to [ST – F0(T)], with the payoff equal to profit because no cash is exchanged at inception. For the buyer of a call option with an exercise price of F0(T),

Π = max[0, ST – F0(T)] – c0.

Setting the forward payoff/profit [ST – F0(T)] equal to the call option profit, Π, gives us the following relative profit profile between the forward and option:

- ST – F0(T) > –c0 Forward profit exceeds option profit

- ST – F0(T) = –c0 Forward profit equals call option profit

- ST – F0(T) < –c0 Option profit exceeds forward profit

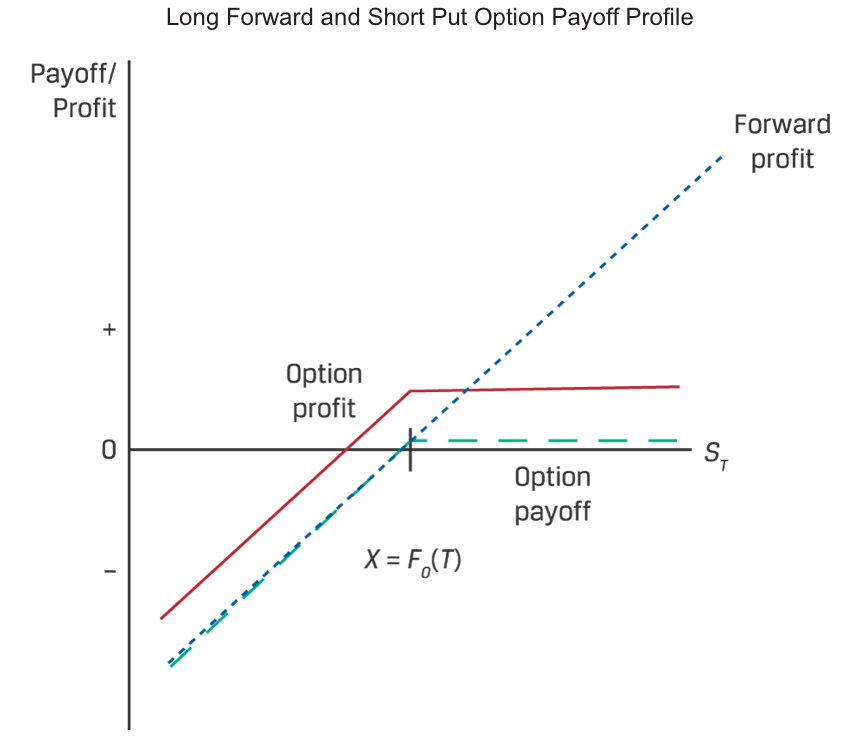

Π = –max[0, F0(T) – ST ] + p0.

Setting the forward profit [ST – F0(T)] equal to the put option profit, Π, gives us the following relative profit profile between the forward and option:

- ST – F0(T) > p0 Forward profit exceeds option profit

- ST – F0(T) = p0 Forward profit equals option profit

- ST – F0(T) < p0 Option profit exceeds forward profit