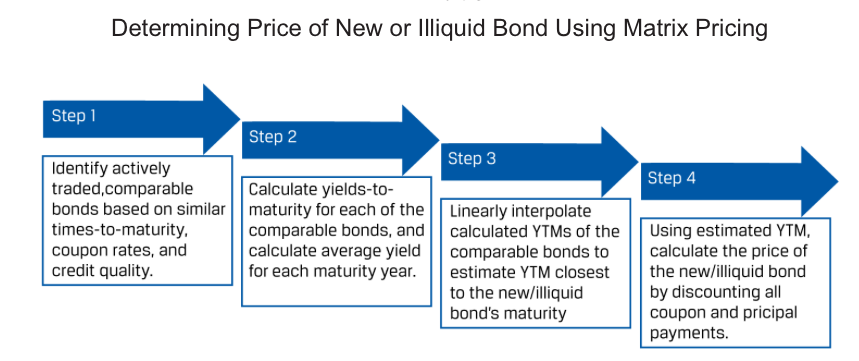

Matrix Pricing Process

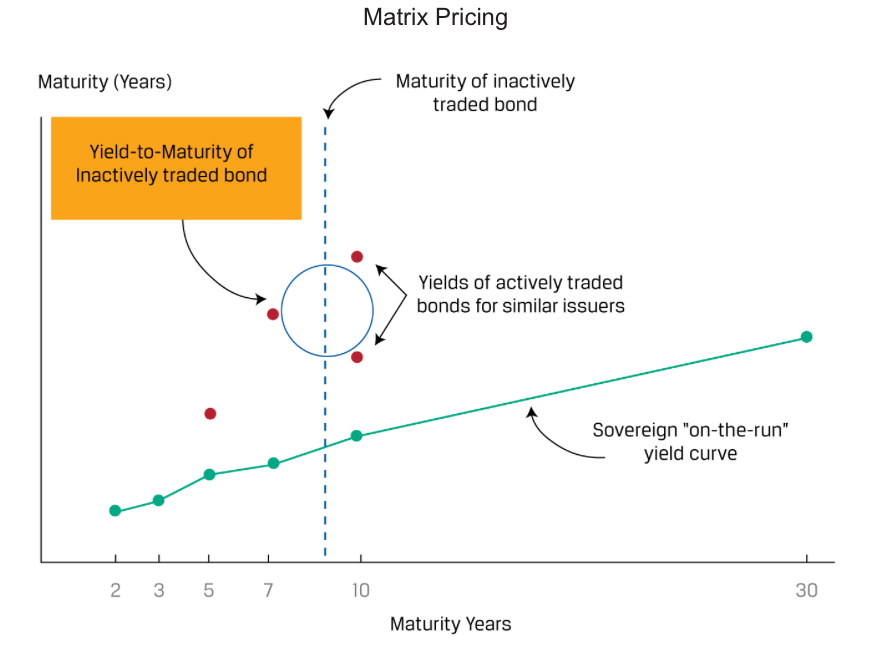

Unlike listed equity securities, most bonds are not actively traded, so there is often no current market price available to calculate yield-to-maturity.

Matrix pricing also is used in underwriting new bonds to get an estimate of the required yield spread over the benchmark rate, or the difference in yield-to-maturity between the bond and that of a government benchmark bond with the same or a similar time-to-maturity.