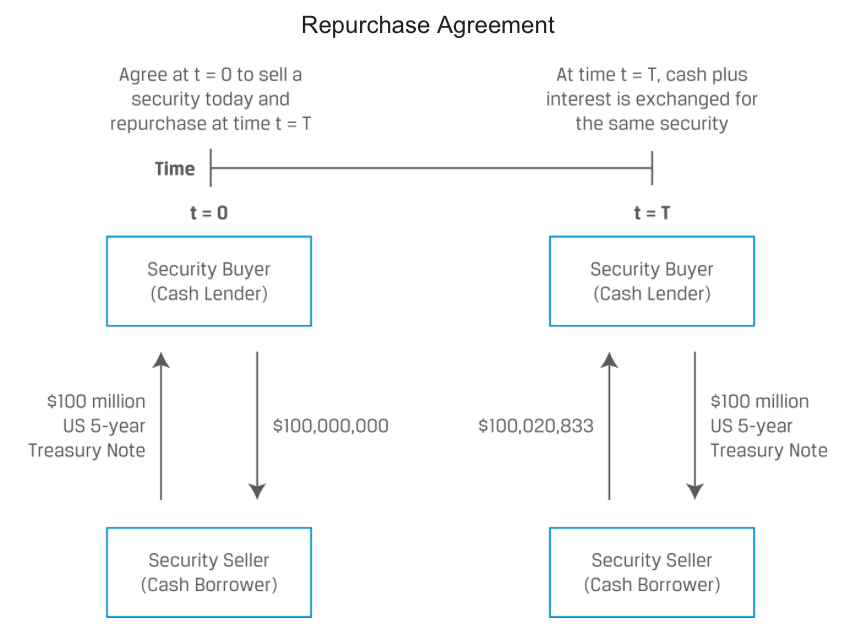

An important source of secured short-term lending and borrowing is the repurchase agreement (repo) market. A repurchase agreement, or repo, involves the sale of a security with a simultaneous agreement by the seller to buy the same (or a similar) security back from the purchaser at an agreed-on repurchase price and future date called the repurchase date.

In addition to the high quality of underlying securities, repos include features designed to reduce the risk of a collateral shortfall over the contract life. One such feature is the provision of collateral in excess of the cash exchanged, known as initial margin, defined as the following ratio:

A 100% initial margin indicates a fully collateralised loan, while a higher margin indicates even greater initial collateral protection. This is alternatively considered a reduction or haircut of the underlying loan relative to the initial collateral value, which may be shown as follows:

Repos address collateral value changes by granting contract participants the right to request additional collateral (or release existing collateral) to maintain a security interest equal to the original initial margin terms. This variable margin payment (referred to as variation margin) is equal to the difference between current margin required and the security’s price at time t, as shown in

Repurchase Agreement Applications and Benefits

Financial market participants use the repo market for three specific purposes:

- Finance the ownership of a security

- Earn short-term income by lending funds on a secured basis

- Borrow a security in order to sell it short

Risk Associated with Repurchase Agreements