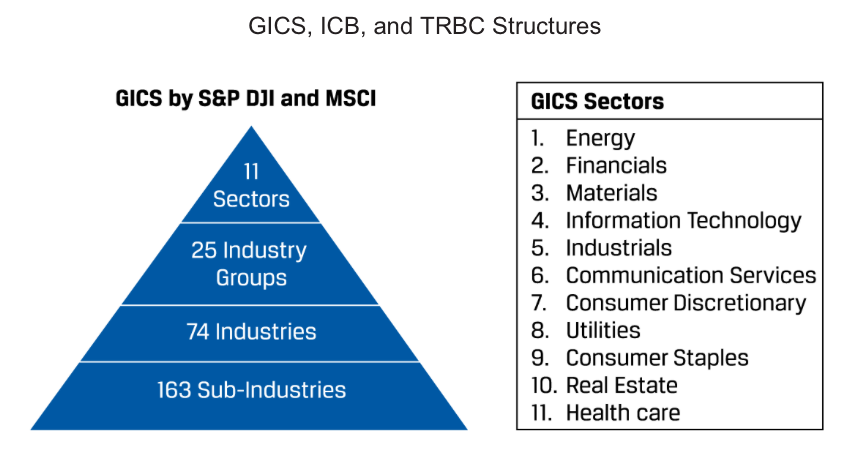

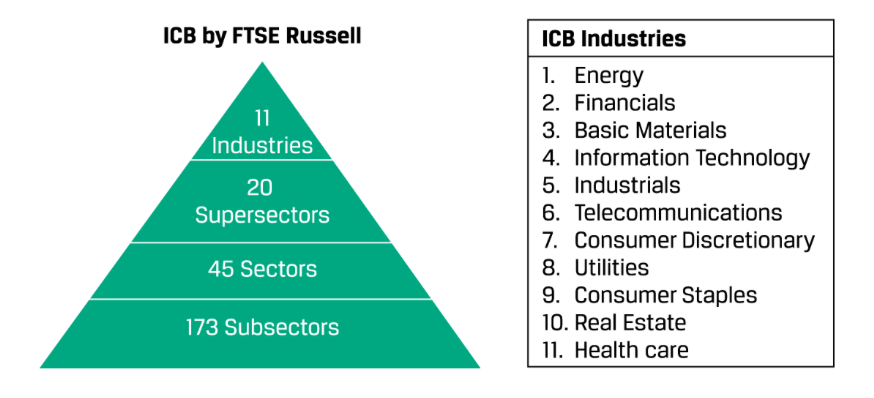

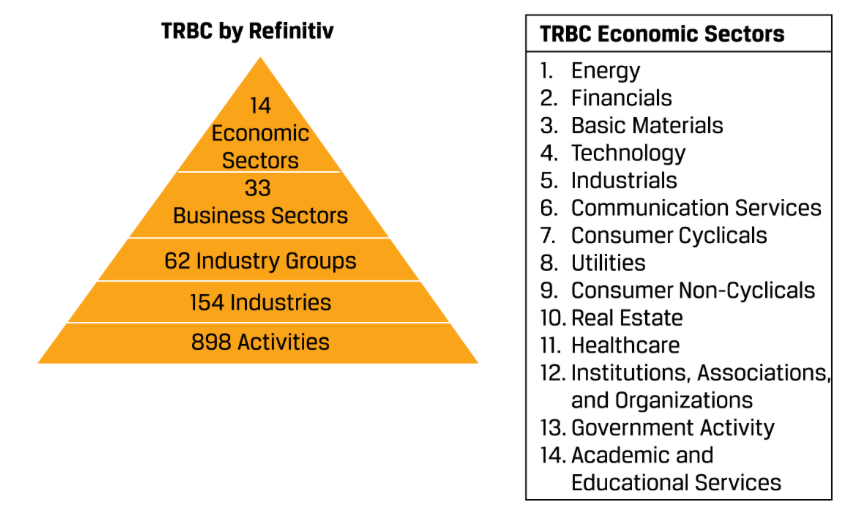

Third-Party Industry Classification Schemes

Early third-party industry classification schemes such as SIC, NACE, and ISIC were devised by government agencies, tended to be country-specific, and grouped companies by their production characteristics into industries such as agriculture, manufacturing, distribution, retail, and services.

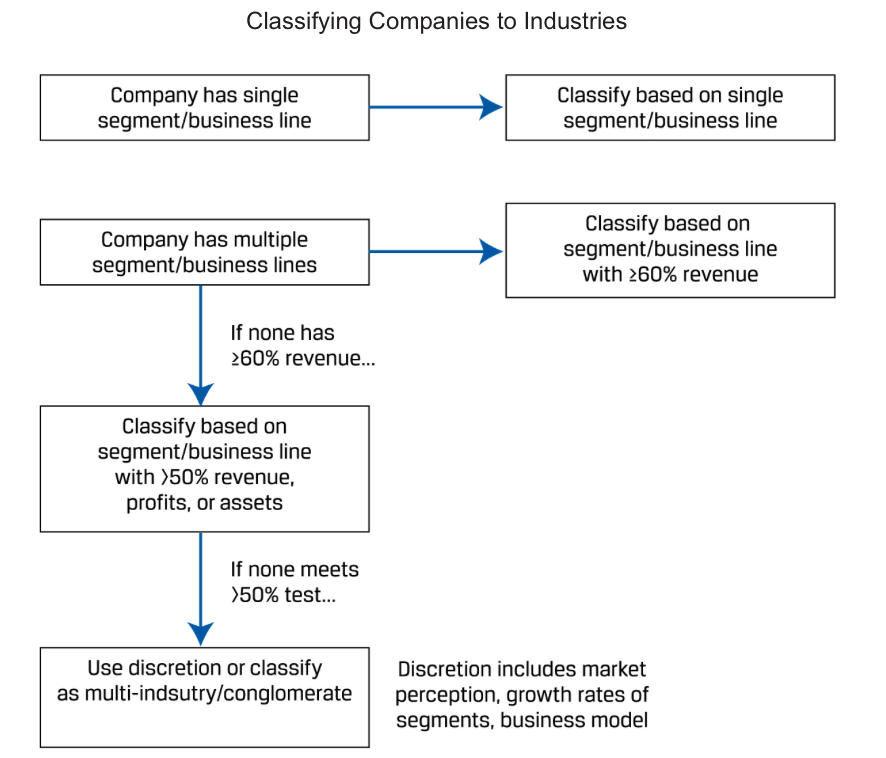

GICS, ICB, and TRBC also have slightly different rules for companies operating in multiple industries, all of which use some discretion.

Limitations of Third-Party Industry Classification Schemes

While these classification schemes are a useful starting place for research (and they have other uses like index construction and investment performance attribution, described elsewhere in the curriculum), they have four important limitations that analysts must contend with in doing industry research:

- Groupings of companies with business model variations or that sell substitute products

- The classification of multi-product companies

- Geographical considerations

- Changes in groupings over time that affect prior-period comparability of industry statistics

Alternative Methods of Grouping Companies

An industry or product approach to grouping companies is not the only grouping method and may be less useful in contexts outside industry analysis. Other approaches that are used in contexts such as index construction and investment performance evaluation include the following:

- Geography, in which companies are classified by country and then countries are aggregated into categories such as developed, emerging, and frontier markets.

- Sensitivity to the business cycle, with groupings such as “defensive” and “cyclical.” Defensive companies are those whose sales growth, profitability, and valuations are less affected by changes in broad macroeconomic activity (e.g., GDP growth), while the opposite is true of cyclicals.

- Statistical similarities, or the use of clustering analysis to group companies based on similarities of financial ratios and market data or co-movements of their securities’ investment returns.

- ESG characteristics, such as the ratio of carbon emissions to revenues, measures of board and executive personnel diversity, and exposure to certain businesses such as tobacco and gambling.