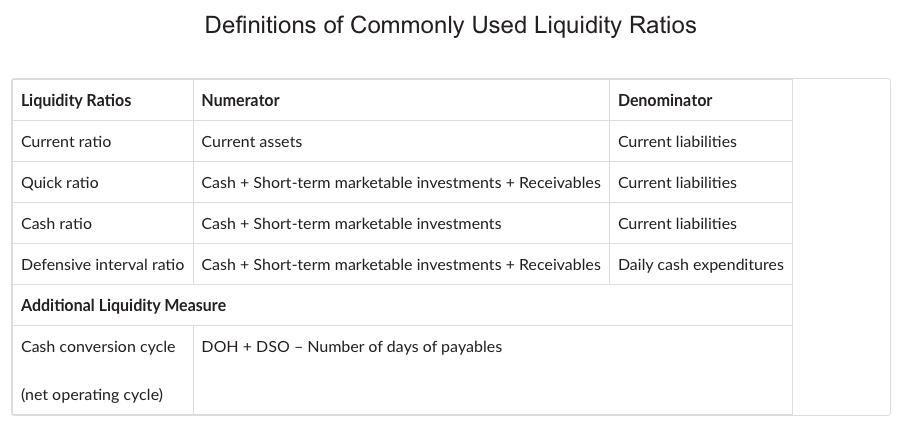

Liquidity analysis measures a company’s ability to meet its short-term obligations.

Calculation of Liquidity Ratios

The defensive interval ratio measures how long a company can pay its daily cash expenditures using only its existing liquid assets, without additional cash flow coming in.

Interpretation of Liquidity Ratios

Current Ratio

A higher current ratio indicates a higher level of liquidity (i.e., a greater ability to meet short-term obligations). A lower ratio indicates less liquidity, implying a greater reliance on operating cash flow and outside financing to meet short-term obligations. The current ratio implicitly assumes that inventories and accounts receivable are indeed liquid (which is presumably not the case when related turnover ratios are low).

Quick Ratio

The quick ratio is more conservative than the current ratio because it includes only the more liquid current assets (sometimes referred to as “quick assets”) in relation to current liabilities. Like the current ratio, a higher quick ratio indicates greater liquidity.

Cash Ratio

The cash ratio normally represents a reliable measure of an entity’s liquidity in a crisis situation.

Defensive Interval Ratio

The defensive interval ratio measures how long the company can continue to pay its expenses from its existing liquid assets without receiving any additional cash inflow.

Cash Conversion Cycle (Net Operating Cycle)

This cash conversion cycle metric indicates the amount of time that elapses from the point when a company invests in working capital until the point at which the company collects cash.