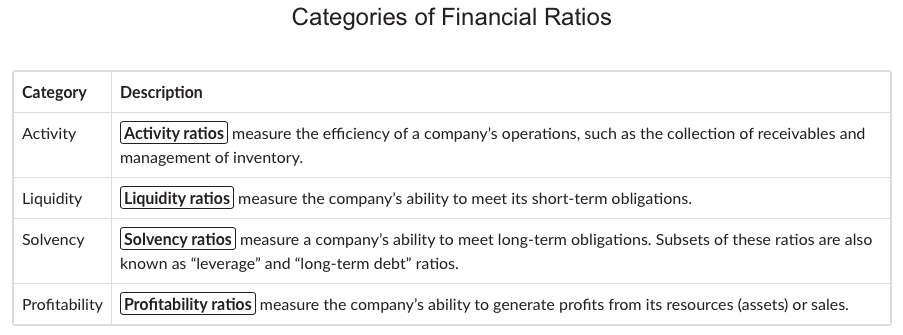

Interpretation and Context

Financial ratios can be interpreted only in the context of other information. In general, the financial ratios of a company are compared with those of its major competitors (cross-sectional and trend analysis) and to the company’s prior periods (trend analysis). The goal is to understand the underlying causes of divergence between a company’s ratios and those of the industry. Even ratios that remain consistent require understanding because consistency can sometimes indicate accounting policies selected to smooth earnings. An analyst should evaluate financial ratios in the context of the following:

- Prior period results. Trend analysis can reveal whether a company’s performance and position are weakening or strengthening.

- Expectations. These are point or range estimates for key values, such as sales growth, profit margins, and leverage ratios, that are specified by the analyst or external analysts before results are published. Differences from expectations should be scrutinised for setting expectations in subsequent periods.

- Industry peers and competitors (cross-sectional analysis). A company can be compared with others in its industry by relating its financial ratios to industry norms or to a subset of the companies in an industry. When industry norms are used to make judgments, care must be taken for the following reasons:

- Companies may have several different lines of business. This will cause aggregate financial ratios to be distorted. It is better to examine industry-specific ratios by lines of business.

- Differences in business model and corporate strategies can affect certain financial ratios.

- Some ratios are industry specific, and not all ratios are important to all industries.

- Differences in accounting methods used by companies can distort financial ratios.

- Company goals and strategy. Actual ratios can be compared with company objectives to determine whether objectives are being attained and whether the results are consistent with the company’s strategy.

- Economic conditions. For cyclical companies, financial ratios tend to improve when the economy is strong and weaken during recessions. Therefore, financial ratios should be examined in light of the current phase of the business cycle.