Ratios used in analysing fixed assets include the fixed asset turnover ratio and several asset age ratios. The fixed asset turnover ratio (total revenue divided by average net fixed assets) reflects the relationship between total revenues and investment in PPE (property, plant, & equipment). The higher this ratio, the higher the amount of sales a company is able to generate with a given amount of investment in fixed assets. A higher asset turnover ratio is often interpreted as an indicator of greater efficiency.

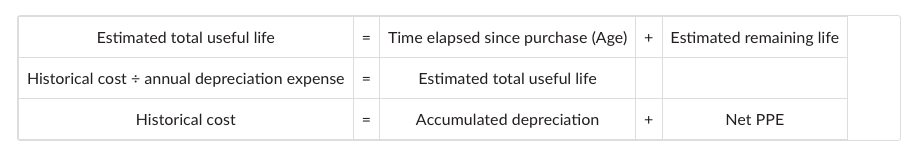

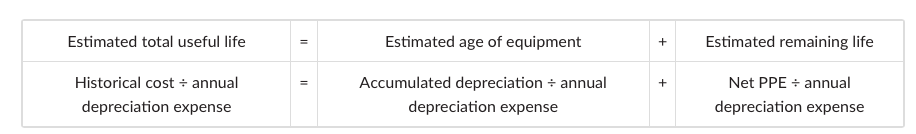

Asset age ratios generally rely on the relationship between historical cost and depreciation. Under the revaluation model (permitted under IFRS but not US GAAP), the relationship between carrying amount, accumulated depreciation, and depreciation expense will differ when the carrying amount differs significantly from the depreciated historical cost. Therefore, the following discussion of asset age ratios applies primarily to PPE reported under the cost model.