Analysis of a company’s balance sheet can provide insight into the company’s liquidity and solvency—as of the balance sheet date—as well as the economic resources the company controls.

Liquidity refers to a company’s ability to meet its short-term financial commitments. Assessments of liquidity focus on a company’s ability to convert assets to cash to pay for operating needs.

Solvency refers to a company’s ability to meet its financial obligations over the longer term. Assessments of solvency focus on the company’s financial structure and its ability to pay long-term financing obligations.

Common-Size Analysis of the Balance Sheet

Vertical common-size analysis, involves stating each balance sheet item as a percentage of total assets.

Common-size balance sheets can also highlight differences in companies’ strategies.

Common-size analysis of the balance sheet is particularly useful in cross-sectional analysis—comparing companies to each other for a particular time period or comparing a company with industry or sector data. The analyst could select individual peer companies for comparison, use industry data from published sources, or compile data from databases. When analysing a company, many analysts prefer to select the peer companies for comparison or to compile their own industry statistics.

Some interesting general observations can be made from these data

- Energy and utility companies have the largest amounts of PP&E. Telecommunication services, followed by utilities, have the highest level of long-term debt. Utilities also use some preferred stock.

- Financial companies have the greatest percentage of total liabilities. Financial companies typically have relatively high financial leverage.

- Utility and real estate companies have the lowest level of receivables.

- Inventory levels are highest for consumer discretionary. Materials and consumer staples have the next highest inventories.

- Information technology companies use the least amount of leverage as evidenced by the lowest percentages for long-term debt and total liabilities and highest percentages for common and total equity.

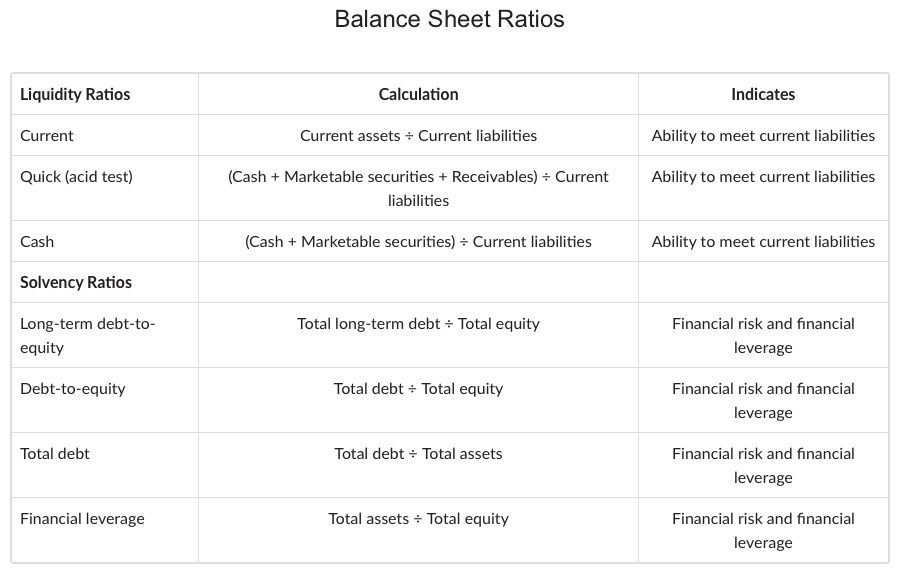

Balance Sheet Ratios

Balance sheet ratios are those involving balance sheet items only. Each of the line items on a vertical common-size balance sheet is a ratio in that it expresses a balance sheet amount in relation to total assets. Other balance sheet ratios compare one balance sheet item to another.

Balance sheet ratios include liquidity ratios (measuring the company’s ability to meet its short-term obligations) and solvency ratios (measuring the company’s ability to meet long-term and other obligations).