The Lognormal Distribution

A random variable Y follows a lognormal distribution if its natural logarithm, ln Y, is normally distributed. The reverse is also true: If the natural logarithm of a random variable Y, ln Y, is normally distributed, then Y follows a lognormal distribution.

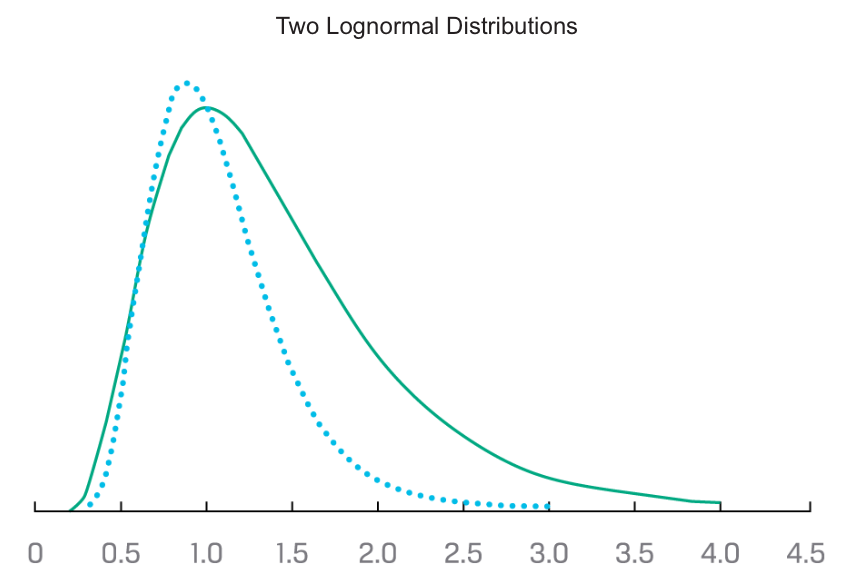

Like the normal distribution, the lognormal distribution is completely described by two parameters. Unlike many other distributions, a lognormal distribution is defined in terms of the parameters of a different distribution. The two parameters of a lognormal distribution are the mean and standard deviation (or variance) of its associated normal distribution: the mean and variance of ln Y, given that Y is lognormal. So, we must keep track of two sets of means and standard deviations (or variances): (1) the mean and standard deviation (or variance) of the associated normal distribution (these are the parameters) and (2) the mean and standard deviation (or variance) of the lognormal variable itself.

The expressions for the mean and variance of a lognormal variable are summarized below, where μ and σ2 are the mean and variance of the associated normal distribution (refer to these expressions as needed, rather than memorizing them):

- Mean (μL) of a lognormal random variable = exp(μ + 0.50σ2).

- Variance (σL2) of a lognormal random variable = exp(2μ + σ2) × [exp(σ2) − 1].

Continuously Compounded Rates of Return

Showing that the stock price at some future time T, PT , equals the current stock price, P0, multiplied by e raised to power r0,T , the continuously compounded return from 0 to T:

PT = P0exp(r0,T).

The continuously compounded return to time T, is the sum of the one-period continuously compounded returns, as follows:

r0,T = rT−1,T + rT−2,T−1 + . . . + r0,1.

A key assumption in many investment applications is that returns are independently and identically distributed (i.i.d.). Independence captures the proposition that investors cannot predict future returns using past returns. Identical distribution captures the assumption of stationarity, a property implying that the mean and variance of return do not change from period to period.

Assume that the one-period continuously compounded returns (such as r0,1) are i.i.d. random variables with mean μ and variance σ2 (but making no normality or other distributional assumption). Then,

E(r0,T) = E(rT−1,T) + E(rT−2,T−1) + . . . + E(r0,1) = μT,

(we add up μ for a total of T times), and

σ2(r0,T) = σ2 T

(as a consequence of the independence assumption).

Volatility measures the standard deviation of the continuously compounded returns on the underlying asset; by convention, it is stated as an annualised measure.